Top Industry Leaders in the Small Cell Networks Market

Competitive Landscape of Small Cell Networks Market

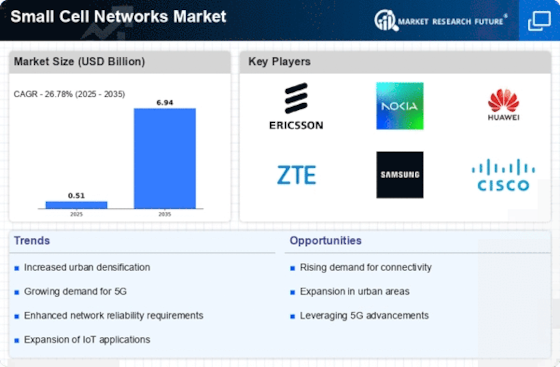

The small cell networks market is experiencing significant growth, driven by the ever-increasing demand for enhanced mobile data connectivity, particularly in high-traffic areas. This market is characterized by a dynamic and fragmented competitive landscape, with established players jostling for market share alongside innovative new entrants. This report dives into the key players, their strategies, and factors influencing market share analysis, providing a snapshot of the current investment trends and highlighting promising newcomers.

Key Players:

- Ericsson (Sweden)

- Qualcomm Telecommunications (U.S.)

- ZTE Corporation (China)

- CommScope Inc. (U.S.)

- Hitachi, Ltd.(Japan)

- Airspan Networks, Inc. (U.S.)

- Cisco Systems, Inc.(U.S.)

- Texas Instruments (U.S.)

- CommScope Inc. (U.S.)

- Huawei Technologies Co., Ltd.(China)

- Cisco Systems, Inc.(U.S.)

- Nokia (Finland)

Strategies for Success:

- Established Giants: The market is dominated by established technology giants like Nokia, Ericsson, Huawei, and Cisco. These players leverage their extensive experience, global reach, and R&D prowess to offer a comprehensive range of small cell solutions, including femtocells, picocells, and microcells. Their focus lies on catering to diverse deployment scenarios, from enterprise campuses to public hotspots.

- Specialized Vendors: Several specialized vendors like Airspan Networks, CommScope, and Quanta Computer carve out a niche by focusing on specific small cell segments or offering innovative solutions. Airspan, for instance, excels in outdoor deployments, while CommScope targets In-building solutions. These players often exhibit agility and faster innovation cycles compared to larger companies.

- Telecom Operators: Leading telecom operators like Verizon, AT&T, and China Mobile are increasingly investing in deploying and managing their own small cell networks. This vertical integration allows them to optimize network performance and cater to specific customer needs, but also necessitates significant upfront investments and expertise.

Strategies for Success:

- Technology Innovation: Continuous innovation in areas like beamforming, interference mitigation, and network densification is crucial for differentiation in the market. Players are actively investing in research and development of 5G-compatible small cells to capitalize on the upcoming wave of network upgrades.

- Partnerships and Acquisitions: Strategic partnerships with network operators, system integrators, and technology providers are common to expand reach, access expertise, and develop comprehensive solutions. Additionally, acquisitions of smaller players with niche expertise can accelerate growth and market share acquisition.

- Focus on Verticals: Targeting specific verticals like enterprises, stadiums, and transportation hubs with customized solutions is another key strategy. This allows players to cater to unique needs and pain points, fostering deeper customer relationships and recurring revenue streams.

Factors for Market Share Analysis:

- Product Portfolio: The breadth and depth of a player's small cell product portfolio, encompassing different types, technologies, and functionalities, significantly impacts market share. Offering solutions across diverse deployment scenarios caters to a wider customer base.

- Geographic Reach: A global presence with established distribution channels and partnerships with local players is crucial for capturing market share in different regions. Understanding regional regulations and tailoring solutions accordingly are essential.

- Innovation and R&D Investments: Continuous investment in research and development to stay ahead of the technological curve and offer differentiated solutions is vital. Early adoption of next-generation technologies like 5G can provide a significant competitive edge.

- Customer Service and Support: Providing excellent customer service and support, including network planning, deployment, and maintenance, fosters customer loyalty and repeat business, ultimately contributing to market share growth.

New and Emerging Companies:

Several new and emerging companies are disrupting the small cell market with innovative solutions and business models. Examples include:

- DenseAir: Focused on ultra-dense networks using millimeter wave technology for high-capacity deployments in urban areas.

- Astevia: Specializes in software-defined small cells, offering flexible and scalable solutions for diverse deployment scenarios.

- Federated Wireless: Offers cloud-based small cell solutions, minimizing reliance on traditional base stations and enabling rapid network deployments.

These companies leverage their agility and focus on niche areas to challenge established players and capture market share.

Current Investment Trends:

- 5G-compatible small cells: With the rollout of 5G networks gaining momentum, investments in 5G-ready small cells are surging. Players are focusing on developing solutions with higher capacities, lower latency, and improved network efficiency.

- Edge computing integration: Integrating edge computing capabilities into small cells is gaining traction, enabling real-time data processing and analysis at the network edge, which is crucial for applications like IoT and augmented reality.

- OpenRAN adoption: Open Radio Access Network (OpenRAN) principles are being increasingly adopted, creating opportunities for new entrants and fostering innovation in the small cell market.

Latest Company Updates:

January 17, 2024: Verizon and Qualcomm announced a collaboration to develop and offer private 5G network solutions using small cell technology. This partnership aims to cater to enterprises across various industries seeking secure and ultra-reliable connectivity for IoT applications.

January 15, 2024: Huawei launched its latest line of 5G small cell products, including indoor and outdoor models, targeted at enterprises and public spaces. These new solutions boast compact designs, high performance, and improved energy efficiency.

Date: January 10, 2024: The Federal Communications Commission (FCC) adopted new rules to streamline the approval process for small cell deployments. These changes aim to expedite network infrastructure upgrades and facilitate the rollout of 5G services in the United States.

January 9, 2024: Astevia, a provider of software-defined small cells, unveiled its new AI-powered network management platform. This platform utilizes machine learning to automate network optimization, resource allocation, and troubleshooting, reducing operational costs and improving network performance.