Growing Mobile Data Traffic

The small cell-networks market in Japan is being propelled by the exponential growth of mobile data traffic. With the increasing reliance on mobile devices for communication, entertainment, and business operations, the demand for high-capacity networks is more pressing than ever. Reports indicate that mobile data traffic in Japan is expected to increase by over 30% annually, necessitating the deployment of small cell networks to alleviate congestion in existing infrastructure. This trend underscores the importance of small cell networks in ensuring that users experience uninterrupted service and high-speed connectivity, thereby driving market growth.

Supportive Regulatory Environment

The regulatory environment in Japan is fostering the growth of the small cell-networks market. Government policies aimed at promoting telecommunications infrastructure development are creating a favorable landscape for small cell deployment. Regulatory bodies are streamlining the approval processes for small cell installations, which encourages operators to invest in expanding their networks. This supportive framework is essential for addressing the connectivity needs of urban populations and enhancing overall network performance. As a result, the small cell-networks market is likely to benefit from increased investments and accelerated deployment timelines, contributing to its overall expansion.

Rising Demand for Enhanced Connectivity

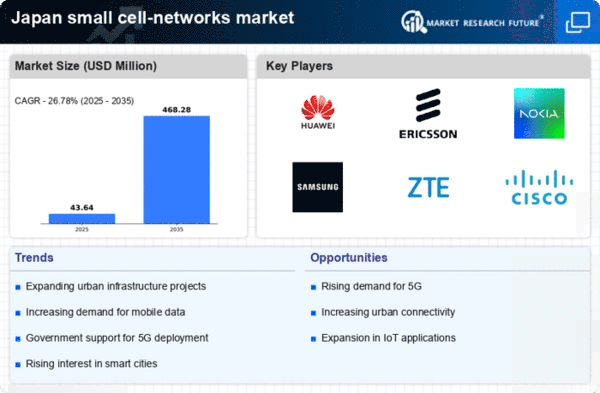

The small cell-networks market in Japan is experiencing a notable surge in demand for enhanced connectivity solutions. As urban areas become increasingly congested, the need for reliable and high-speed internet access is paramount. This demand is driven by the proliferation of smart devices and the Internet of Things (IoT), which require robust network infrastructure. According to recent data, the small cell-networks market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the market's potential to address the connectivity challenges faced by densely populated regions in Japan, thereby fostering a more connected society.

Increased Investment in Smart City Initiatives

Japan's commitment to developing smart cities is significantly impacting the small cell-networks market. Government initiatives aimed at enhancing urban infrastructure are driving investments in advanced communication technologies. The integration of small cell networks is vital for the successful implementation of smart city projects, which rely on seamless connectivity for various applications, including traffic management and public safety. As municipalities allocate funds for these initiatives, the small cell-networks market is poised for growth. It is estimated that investments in smart city projects could exceed $10 billion by 2027, further solidifying the role of small cell networks in urban development.

Technological Advancements in Network Infrastructure

Technological advancements play a crucial role in shaping the small cell-networks market in Japan. Innovations such as 5G technology and advanced antenna systems are enhancing the capabilities of small cell networks, allowing for greater data throughput and reduced latency. These advancements are essential for supporting the increasing data demands of consumers and businesses alike. The integration of artificial intelligence and machine learning into network management systems is also streamlining operations and improving efficiency. As a result, the small cell-networks market is likely to witness a significant transformation, with an expected market value reaching approximately $1 billion by 2026.