Increased Focus on Smart City Initiatives

The small cell-networks market is significantly influenced by the growing emphasis on smart city initiatives within the UK. As urban areas evolve, there is a pressing need for advanced communication networks to support various smart technologies, such as traffic management systems, public safety applications, and environmental monitoring. Small cells play a crucial role in enabling these technologies by providing the necessary connectivity. The UK government has allocated substantial funding towards smart city projects, which is expected to drive the adoption of small cell solutions. The small cell-networks market stands to gain from this trend, as municipalities seek to enhance their infrastructure to support a connected urban environment. This integration of small cells into smart city frameworks may also lead to improved operational efficiencies and enhanced quality of life for residents.

Growing Demand for Enhanced Mobile Services

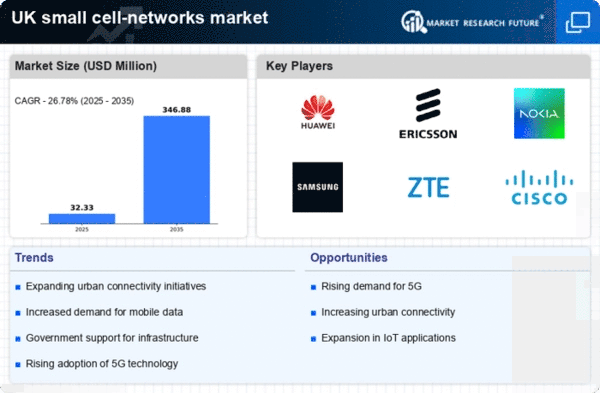

The small cell-networks market is experiencing a surge in demand for enhanced mobile services, driven by the increasing reliance on mobile devices for daily activities. As consumers and businesses alike seek faster and more reliable connectivity, the need for small cell solutions becomes apparent. In the UK, mobile data traffic is projected to grow at a compound annual growth rate (CAGR) of approximately 30% over the next five years. This growth necessitates the deployment of small cells to alleviate congestion in urban areas, thereby improving user experience. The small cell-networks market is thus positioned to benefit from this trend, as operators invest in infrastructure to meet consumer expectations for seamless connectivity. Furthermore, the proliferation of IoT devices is likely to further fuel this demand, as these devices require consistent and robust network coverage.

Emerging Opportunities in Rural Connectivity

The small cell-networks market is poised to capitalise on emerging opportunities in rural connectivity, as the UK government prioritises bridging the digital divide between urban and rural areas. With a significant portion of the rural population lacking access to reliable mobile services, small cells present a viable solution for enhancing coverage in these regions. The small cell-networks market is likely to benefit from government initiatives aimed at improving digital infrastructure in rural communities. Recent funding programs have been established to support the deployment of small cell technology in these underserved areas, which could lead to increased market penetration. As operators respond to this demand, the small cell-networks market may see a shift in focus towards rural deployments, ultimately contributing to greater inclusivity in mobile connectivity.

Rising Adoption of Mobile Broadband Services

The small cell-networks market is witnessing a notable increase in the adoption of mobile broadband services, which is reshaping the telecommunications landscape in the UK. With more consumers opting for mobile broadband over traditional fixed-line services, there is a growing need for robust network solutions that can handle high data demands. The small cell-networks market is well-positioned to address this shift, as small cells can effectively enhance coverage and capacity in densely populated areas. Recent statistics indicate that mobile broadband subscriptions in the UK have surpassed 80 million, reflecting a strong consumer preference for mobile connectivity. This trend is likely to continue, prompting operators to invest in small cell technology to ensure they can meet the evolving needs of their customer base.

Regulatory Support for Infrastructure Development

The small cell-networks market is bolstered by regulatory support aimed at facilitating infrastructure development across the UK. Government initiatives and policies are increasingly recognising the importance of enhancing mobile connectivity, particularly in underserved areas. The UK government has set ambitious targets for digital infrastructure, including the rollout of 5G technology, which inherently relies on small cell deployments. Recent legislation has streamlined the planning process for small cell installations, reducing barriers for operators. This regulatory environment encourages investment in the small cell-networks market, as it provides a clearer framework for deployment. As a result, operators are more likely to engage in partnerships and collaborations to expand their small cell networks, ultimately leading to improved service delivery and customer satisfaction.