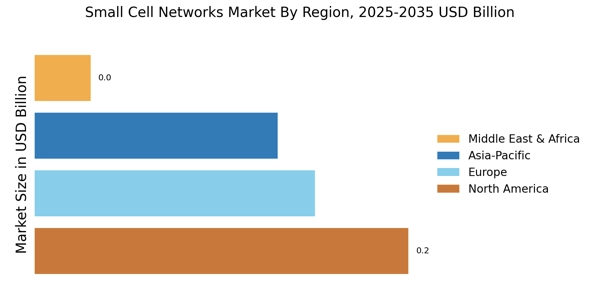

North America : Technology Adoption Leader

North America is the largest market for small cell networks, holding approximately 40% of the global share. The region's growth is driven by the increasing demand for high-speed internet and mobile data services, alongside supportive regulatory frameworks that encourage infrastructure investment. The rollout of 5G technology is a significant catalyst, with major cities rapidly adopting small cell solutions to enhance network capacity and coverage. The United States leads the market, with significant contributions from Canada. Key players such as Cisco, Qualcomm, and Ericsson are heavily invested in the region, driving innovation and competition. The competitive landscape is characterized by strategic partnerships and collaborations aimed at expanding service offerings and improving network efficiency. The presence of advanced technology firms further solidifies North America's position as a leader in small cell networks. North America accounted for the largest small cell networks market share in 2024, supported by early 5G adoption, strong telecom infrastructure, and continuous investments by major network operators. The US small cell networks market leads regional growth, supported by aggressive 5G deployments, urban densification, and strong investments from major telecom operators. The Canada small cell networks market is growing steadily as operators enhance coverage in urban centers and invest in next-generation wireless infrastructure.

Europe : Emerging Market Dynamics

Europe is witnessing a robust growth trajectory in the small cell networks market, accounting for approximately 30% of the global share. The demand is fueled by the increasing need for enhanced mobile connectivity and the European Union's initiatives to promote digital infrastructure. Regulatory support, including funding for 5G deployment, is a key driver, enabling operators to invest in small cell technology to meet consumer demands. Leading countries in this region include Germany, the UK, and France, where major telecom operators are actively deploying small cell solutions. The competitive landscape features significant players like Nokia and Ericsson, who are collaborating with local governments to enhance network capabilities. The focus on sustainability and energy efficiency in network deployment is also shaping the market, as operators seek to reduce their carbon footprint. The Europe small cell networks market is expanding steadily, driven by regional 5G rollout initiatives, supportive regulatory frameworks, and rising demand for enhanced indoor and outdoor connectivity. The UK small cell networks market benefits from nationwide 5G expansion plans and increasing demand for high-capacity urban connectivity. The Germany small cell networks market is driven by industrial digitalization, smart manufacturing initiatives, and strong enterprise connectivity requirements. The France small cell networks market is expanding as telecom operators focus on improving indoor coverage and network capacity in dense urban areas. The Italy small cell networks market is witnessing moderate growth, supported by ongoing network modernization and smart city initiatives. The Spain small cell networks market is gaining momentum due to increasing mobile data usage and the deployment of advanced wireless infrastructure.

Asia-Pacific : Rapid Expansion and Innovation

Asia-Pacific is emerging as a powerhouse in the small cell networks market, holding around 25% of the global share. The region's growth is driven by the rapid urbanization and increasing smartphone penetration, leading to a surge in mobile data consumption. Governments are actively promoting 5G initiatives, which are catalyzing investments in small cell infrastructure to support the growing demand for connectivity. China and Japan are the leading countries in this market, with significant contributions from South Korea. Major players like Huawei and ZTE are at the forefront, driving technological advancements and competitive pricing strategies. The competitive landscape is marked by intense rivalry, with companies focusing on innovation and strategic partnerships to enhance their market presence and service offerings. The region's focus on smart city initiatives further propels the demand for small cell networks. The China small cell networks market is expanding rapidly, supported by large-scale 5G deployments and strong government-led digital infrastructure initiatives. The India small cell networks market is emerging strongly as telecom operators invest in network densification to support rising smartphone penetration. The Japan small cell networks market is characterized by advanced technology adoption and strong demand from smart city and enterprise applications. The South Korea small cell networks market is driven by early 5G adoption, high mobile data consumption, and continuous innovation in wireless technologies.

Middle East and Africa : Emerging Connectivity Solutions

The Middle East and Africa region is gradually emerging in the small cell networks market, accounting for approximately 5% of the global share. The growth is primarily driven by the increasing demand for mobile broadband services and the expansion of telecom infrastructure. Governments are recognizing the importance of digital connectivity, leading to regulatory initiatives that support the deployment of small cell networks to enhance coverage in urban and rural areas. Countries like South Africa and the UAE are leading the charge, with significant investments in telecommunications infrastructure. The competitive landscape features both local and international players, including major firms like Ericsson and Huawei. The focus on improving network reliability and capacity is crucial, as operators aim to meet the growing consumer demand for high-speed internet and mobile services. The region's unique challenges, such as diverse geography, also influence the deployment strategies of small cell networks. The GCC small cell networks market is developing steadily as governments invest in smart city projects and advanced telecom infrastructure.