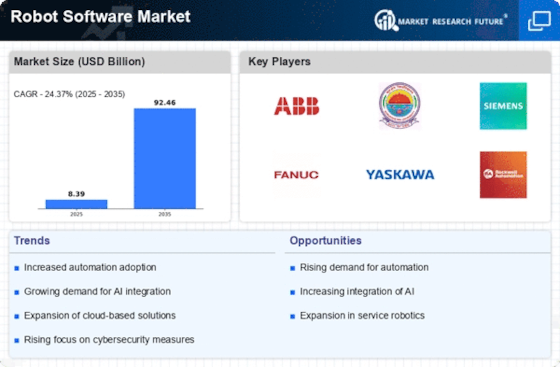

Rising Demand for Automation

The increasing demand for automation across various sectors is a primary driver of the Robot Software Market. Industries such as manufacturing, logistics, and healthcare are increasingly adopting robotic solutions to enhance efficiency and reduce operational costs. According to recent data, the automation market is projected to grow at a compound annual growth rate of over 10% in the coming years. This trend indicates a robust appetite for advanced robotic software that can streamline processes and improve productivity. As organizations seek to remain competitive, the integration of sophisticated robot software becomes essential, thereby propelling the growth of the Robot Software Market.

Growing Focus on Sustainability

The growing emphasis on sustainability is reshaping the Robot Software Market. Organizations are increasingly adopting robotic solutions to minimize waste and enhance energy efficiency. For example, robots equipped with advanced software can optimize supply chain processes, reducing carbon footprints and resource consumption. This shift towards sustainable practices is supported by regulatory frameworks that encourage the adoption of eco-friendly technologies. As a result, the demand for robot software that facilitates sustainable operations is likely to increase, reflecting a broader trend towards environmental responsibility in various industries. This focus on sustainability could potentially redefine market dynamics in the Robot Software Market.

Advancements in Robotics Technology

Technological advancements in robotics are significantly influencing the Robot Software Market. Innovations in sensors, artificial intelligence, and machine learning are enabling robots to perform complex tasks with greater precision and reliability. For instance, the development of collaborative robots, or cobots, allows for safer human-robot interactions, which is crucial in environments like manufacturing floors. The market for robotic software is expected to witness substantial growth, with estimates suggesting a valuation exceeding 30 billion dollars by 2026. This growth is indicative of the increasing reliance on advanced robotic systems, which necessitate sophisticated software solutions to operate effectively.

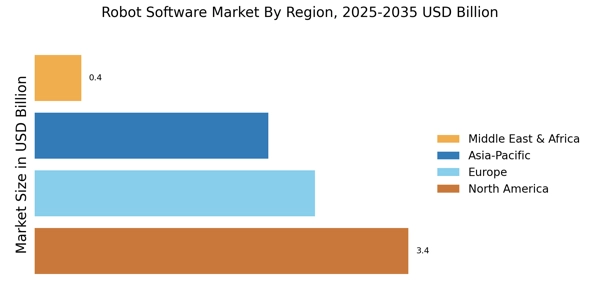

Expansion of E-commerce and Logistics

The expansion of e-commerce and logistics is a crucial driver of the Robot Software Market. As online shopping continues to surge, companies are increasingly relying on robotic solutions to manage inventory, fulfill orders, and streamline distribution processes. The logistics sector is projected to grow significantly, with estimates indicating a market size exceeding 200 billion dollars by 2025. This growth necessitates the implementation of advanced robotic software to enhance operational efficiency and meet consumer demands. Consequently, the Robot Software Market is poised to benefit from this trend, as businesses seek to leverage automation to improve service delivery and reduce costs.

Increased Investment in Research and Development

Investment in research and development is a significant driver of the Robot Software Market. Companies are allocating substantial resources to innovate and enhance robotic capabilities, which in turn fuels the demand for advanced software solutions. This trend is particularly evident in sectors such as automotive and aerospace, where precision and efficiency are paramount. The global investment in robotics R&D is projected to reach unprecedented levels, with estimates suggesting a growth rate of around 15% annually. Such investments not only foster innovation but also create a competitive landscape that necessitates the continuous evolution of robot software, thereby driving the market forward.