Leading market players are spending a lot of money on R&D in order to diversify their product offerings, which will drive the cleaning robot market's expansion. Important market developments include new product releases, contractual agreements, mergers and acquisitions, greater investments, and collaboration with other organizations. Market participants are also engaged in a number of strategic actions to increase their global presence. The cleaning robot industry must provide affordable products if it is to grow and thrive in an increasingly competitive and challenging market environment.

One of the primary strategies adopted by manufacturers in the global cleaning robot industry to assist customers and expand the market sector is local manufacturing to reduce operational costs. Some of the biggest benefits to medicine in recent years have come from the cleaning robot industry.

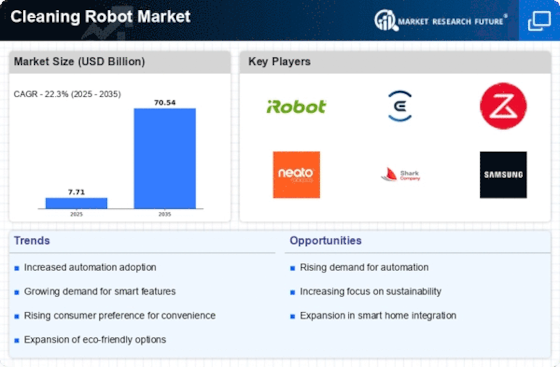

Major players in the cleaning robot market, including iRobot (US) Ecovacs Robotics (China) Samsung Electronics (South Korea) LG Electronics (SouthKorea) Xiaomi (China) Roborock (China) and others, Established companies and new ventures have been doing research and collaborating with various electronic component suppliers to provide efficient cleaning equipment that is integrated with all the major technologies.

Apple Inc.'s iLife is a discontinued software package for macOS and iOS. It includes programs for media creation, organization, editing, and publishing. It includes iTunes, iMovie, iPhoto, iDVD, iWeb, and GarageBand at various points. Just iMovie and GarageBand are still accessible for free on Apple's Mac App Store. iDVD and iWeb have been phased out, and iTunes and iPhoto have been replaced by Music and Photographs, respectively. In January 2022, ILIFE, a manufacturer of robot vacuums and handheld vacuum cleaners, introduced the EASINE W100, its first cordless wet/dry vacuum cleaner.

It has an all-in-one cleaning system that vacuums, scrubs, and mops, as well as a self-cleaning mode that simplifies and saves time.

Haier Group Corporation (/ha.r/)[1] is a Chinese multinational home appliance and consumer electronics corporation based in Qingdao, Shandong. Refrigerators, air conditioners, washing machines, dryers, microwave ovens, mobile phones, computers, and televisions are among the things it creates, develops, manufactures, and sells. The Haier Smart Home business features seven global brands: Haier, Casarte, Leader, GE Appliances, Fisher & Paykel, Aqua, and Candy.

In May In India, Haier, Inc. unveiled its first two-in-one robot vacuum cleaner for dry and wet mopping.

The new product has 2.4 GHz WiFi and Google Home Assistant, which allows for smart administration via voice control, a smart app, and a remote control.