Rising Demand for Automation

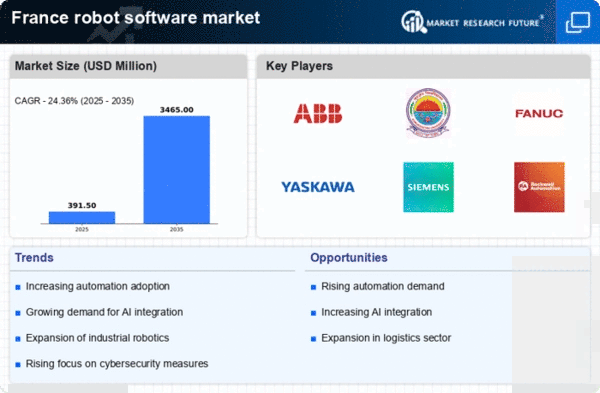

The robot software market in France experiences a notable surge in demand for automation across various sectors. Industries such as manufacturing, logistics, and agriculture are increasingly adopting robotic solutions to enhance efficiency and reduce operational costs. According to recent data, the automation sector in France is projected to grow at a CAGR of approximately 12% over the next five years. This trend indicates a strong inclination towards integrating advanced robotic systems, which necessitates sophisticated software solutions. As companies strive to remain competitive, the need for reliable and efficient robot software becomes paramount. This rising demand for automation is likely to drive innovation and investment in the robot software market, fostering a robust ecosystem that supports the development of cutting-edge technologies.

Expansion of Service Robotics

The robot software market in France is witnessing a notable expansion in the service robotics sector. Service robots, which include applications in hospitality, healthcare, and retail, are becoming increasingly prevalent. This growth is driven by changing consumer preferences and the need for enhanced service delivery. For instance, robots used in healthcare settings for patient assistance and monitoring are gaining traction. The market for service robotics is projected to grow at a CAGR of approximately 10% in the coming years. This expansion necessitates the development of specialized robot software that can cater to the unique requirements of service applications, thereby driving innovation and investment in the robot software market.

Government Initiatives and Funding

The French government actively promotes the adoption of robotics and automation technologies, significantly impacting the robot software market. Initiatives such as the 'France 2030' plan aim to bolster the country's technological capabilities, with substantial funding allocated to research and development in robotics. In 2025, the government announced an investment of €1 billion to support innovative projects in the robotics sector. This financial backing not only encourages startups and established companies to develop advanced robot software but also enhances collaboration between academia and industry. As a result, the robot software market is likely to benefit from increased innovation, leading to the creation of more sophisticated and efficient software solutions tailored to various applications.

Growing Focus on Safety and Compliance

In the context of the robot software market, safety and compliance have emerged as critical drivers. As industries adopt robotic systems, ensuring the safety of both workers and equipment becomes paramount. Regulatory bodies in France are increasingly implementing stringent safety standards for robotic applications. This trend compels companies to invest in advanced robot software that incorporates safety features and compliance mechanisms. For instance, software solutions that enable real-time monitoring and risk assessment are gaining traction. The emphasis on safety not only protects employees but also enhances operational efficiency, thereby driving demand for innovative robot software solutions that meet regulatory requirements.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into robotic systems is transforming the robot software market in France. AI technologies enable robots to perform complex tasks, learn from their environments, and adapt to changing conditions. This evolution is particularly evident in sectors such as logistics and manufacturing, where AI-driven robots can optimize workflows and improve productivity. The market for AI in robotics is expected to grow significantly, with estimates suggesting a CAGR of around 15% over the next five years. As companies seek to leverage AI capabilities, the demand for sophisticated robot software that can harness these technologies is likely to increase, driving further advancements in the market.