Growing Focus on Workforce Safety

The emphasis on workforce safety is increasingly impacting the robot software market in Germany. As industries strive to create safer working environments, the integration of robots for hazardous tasks becomes more prevalent. This shift not only protects employees but also enhances operational efficiency. In 2025, it is projected that the market for safety-oriented robotic solutions will account for approximately 20% of the total robot software market. The robot software market is thus adapting to these safety requirements, leading to the development of software that ensures compliance with safety regulations and enhances the overall reliability of robotic systems.

Government Initiatives and Support

Government policies and initiatives significantly influence the robot software market in Germany. The German government has launched several programs aimed at promoting automation and digitalization within industries. For instance, funding schemes and tax incentives encourage companies to adopt robotic solutions, thereby stimulating market growth. In 2025, public investment in automation technologies is expected to exceed €500 million, underscoring the commitment to enhancing the country's industrial capabilities. This supportive environment fosters a thriving robot software market, as businesses leverage government resources to implement cutting-edge robotic solutions.

Technological Advancements in Robotics

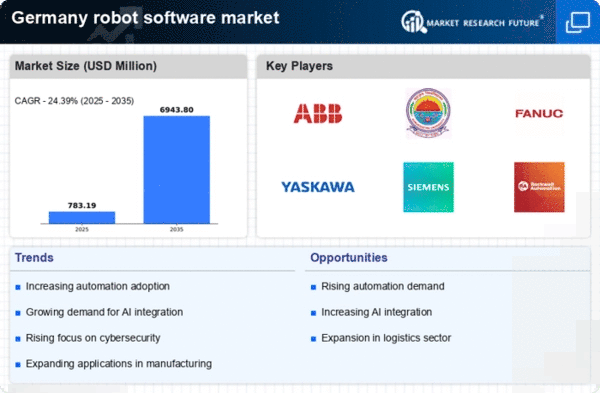

Technological innovations play a crucial role in shaping the robot software market in Germany. The advent of sophisticated algorithms and machine learning capabilities enhances the functionality of robotic systems. In 2025, it is estimated that the market for robotic software will reach €1.5 billion, reflecting a compound annual growth rate (CAGR) of 12% over the next five years. These advancements enable robots to perform complex tasks with greater accuracy and adaptability, thereby expanding their applications across various industries. The robot software market is likely to see increased investment in research and development, fostering a competitive landscape that drives further innovation.

Rising Demand for Industrial Automation

The robot software market in Germany experiences a notable surge in demand driven by the increasing need for industrial automation. As manufacturers seek to enhance productivity and reduce operational costs, the integration of robotic systems becomes essential. In 2025, the automation sector is projected to grow by approximately 15%, indicating a robust shift towards automated solutions. This trend is particularly evident in sectors such as automotive and electronics, where precision and efficiency are paramount. The robot software market is poised to benefit significantly from this demand, as companies invest in advanced software solutions to optimize robotic performance and streamline production processes.

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the robot software market in Germany. Companies are increasingly allocating resources to innovate and improve robotic software capabilities. In 2025, R&D spending in the robotics sector is anticipated to reach €300 million, reflecting a growing recognition of the importance of advanced software solutions. This investment not only fosters technological advancements but also enhances the competitiveness of the robot software market. As firms strive to differentiate their offerings, the focus on R&D is likely to yield new software applications that address emerging market needs.