Government Initiatives and Funding

Government initiatives aimed at promoting technological innovation are playing a crucial role in shaping the robot software market. In the GCC, various governments are investing heavily in technology and innovation to diversify their economies and reduce reliance on oil. For instance, initiatives such as Saudi Arabia's Vision 2030 and the UAE's National Innovation Strategy are fostering an environment conducive to the growth of the robot software market. These initiatives often include funding for research and development, tax incentives for tech companies, and support for startups in the robotics sector. As a result, the The robot software market will likely see increased investment and development, leading to a more vibrant and competitive landscape.

Expansion of E-commerce and Logistics

The rapid expansion of e-commerce in the GCC is significantly influencing the robot software market, particularly in logistics and supply chain management. As online shopping continues to grow, companies are increasingly turning to robotic solutions to streamline their warehousing and distribution processes. The demand for efficient order fulfillment and inventory management is driving investments in robotic automation. According to industry reports, the logistics sector in the GCC is expected to grow by over 15% annually, creating a substantial opportunity for the robot software market. This growth is likely to be fueled by the need for advanced software that can optimize robotic operations, manage inventory, and enhance overall supply chain efficiency.

Growing Focus on Safety and Compliance

The emphasis on safety and compliance in industrial operations is driving the adoption of robotic solutions, thereby impacting the robot software market. In the GCC, industries are increasingly prioritizing workplace safety and regulatory compliance, leading to a greater reliance on robots for hazardous tasks. The implementation of robotic systems not only enhances safety but also ensures adherence to stringent regulations. As companies seek to mitigate risks and improve safety standards, the demand for sophisticated robot software that can monitor compliance and manage safety protocols is likely to rise. This trend suggests a growing market for software solutions that integrate safety features and compliance monitoring capabilities.

Advancements in Artificial Intelligence

The integration of artificial intelligence (AI) into robotic systems is significantly influencing the robot software market. AI technologies enable robots to perform complex tasks, learn from their environments, and adapt to changing conditions. In the GCC, investments in AI research and development are on the rise, with governments and private sectors recognizing the potential of AI-driven robotics. The The robot software market will benefit from these advancements, as AI enhances the capabilities of robots in various applications, including manufacturing, healthcare, and service industries. The potential for AI to improve decision-making processes and operational efficiency suggests a robust future for the robot software market, with AI-driven solutions becoming increasingly essential.

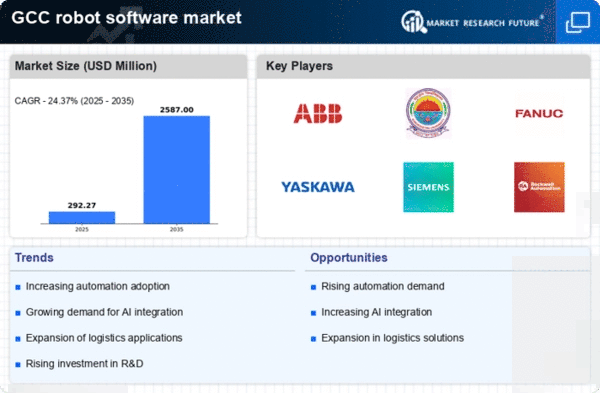

Rising Demand for Industrial Automation

The robot software market is experiencing a notable surge in demand driven by the increasing need for industrial automation across various sectors in the GCC. Industries such as manufacturing, logistics, and construction are increasingly adopting robotic solutions to enhance efficiency and reduce operational costs. According to recent data, the GCC's industrial automation market is projected to grow at a CAGR of approximately 10% from 2025 to 2030. This growth is likely to propel the robot software market as companies seek advanced software solutions to optimize robotic operations, improve productivity, and ensure seamless integration with existing systems. The push for automation is not only about cost savings but also about maintaining competitiveness in a rapidly evolving market landscape.