Rising Demand for Automation

The robot software market in Canada experiences a notable surge in demand for automation across various sectors. Industries such as manufacturing, logistics, and agriculture are increasingly adopting robotic solutions to enhance efficiency and reduce operational costs. According to recent data, the automation market in Canada is projected to grow at a CAGR of approximately 10% over the next five years. This trend indicates a strong inclination towards integrating robotic systems, which in turn drives the demand for sophisticated robot software. As companies seek to streamline processes and improve productivity, the robot software market is likely to benefit significantly from this growing demand for automation.

Government Initiatives and Funding

Government initiatives and funding significantly influence the robot software market in Canada. Various federal and provincial programs aim to promote research and development in robotics and automation. For example, the Canadian government has allocated substantial resources to support innovation in the technology sector, including robotics. This financial backing encourages startups and established companies to invest in developing advanced robot software solutions. The robot software market stands to gain from these initiatives, as increased funding can lead to accelerated innovation and the introduction of cutting-edge products. The potential for government support indicates a favorable environment for growth in the coming years.

Expansion of E-commerce and Logistics

The expansion of e-commerce and logistics sectors is driving growth in the robot software market in Canada. As online shopping continues to gain popularity, companies are increasingly relying on robotic systems to manage inventory, fulfill orders, and streamline supply chain operations. The logistics industry, in particular, is adopting automated solutions to enhance efficiency and reduce delivery times. Recent estimates suggest that the e-commerce sector in Canada could reach a value of $50 billion by 2026, further fueling the demand for advanced robot software. This trend indicates a robust opportunity for the robot software market to develop tailored solutions that meet the evolving needs of e-commerce and logistics.

Growing Focus on Safety and Compliance

Safety and compliance are becoming increasingly critical in the robot software market in Canada. As industries adopt robotic solutions, ensuring that these systems adhere to safety regulations and standards is paramount. Companies are investing in software that not only enhances operational efficiency but also prioritizes safety protocols. This trend is particularly evident in sectors such as manufacturing and healthcare, where compliance with strict regulations is essential. The robot software market is likely to see a rise in demand for software solutions that incorporate safety features and compliance tracking, reflecting a broader commitment to workplace safety and regulatory adherence.

Technological Advancements in Robotics

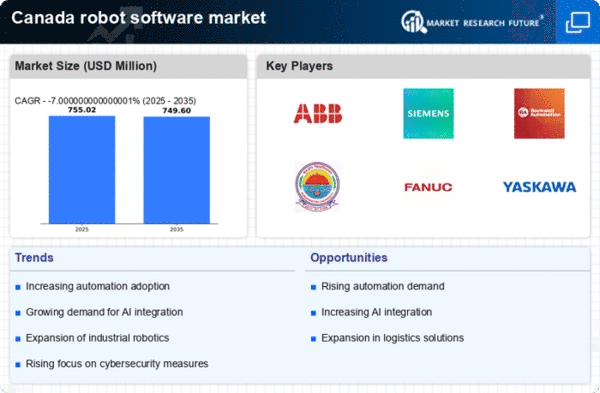

Technological advancements play a crucial role in shaping the robot software market in Canada. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of robotic systems. These advancements enable robots to perform complex tasks with greater precision and adaptability. For instance, the integration of AI algorithms allows robots to learn from their environments and improve their performance over time. As a result, the robot software market is witnessing an influx of new software solutions designed to leverage these technologies. The continuous evolution of robotics technology suggests a promising future for the market, with potential growth rates exceeding 15% annually.