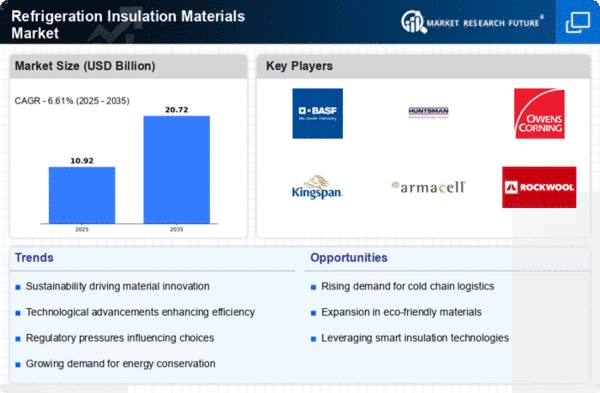

Market Growth Projections

The Global Refrigeration Insulation Materials Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 3.7 USD Billion in 2024 and an anticipated increase to 6.38 USD Billion by 2035, the industry is on a promising trajectory. The compound annual growth rate (CAGR) of 5.09% from 2025 to 2035 indicates a strong market potential driven by various factors, including technological advancements, regulatory support, and rising demand in emerging economies. This growth underscores the importance of insulation materials in enhancing energy efficiency and sustainability across multiple sectors.

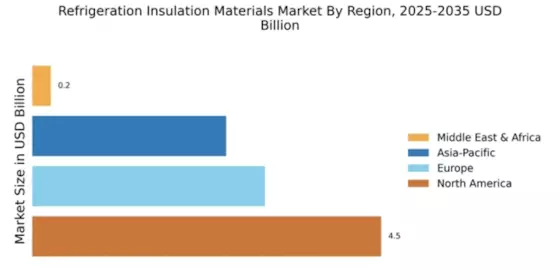

Rising Demand in Emerging Economies

Emerging economies are increasingly contributing to the growth of the Global Refrigeration Insulation Materials Market Industry. Rapid urbanization and industrialization in regions such as Asia-Pacific and Latin America are driving the demand for refrigeration systems, which in turn necessitates effective insulation solutions. As these economies expand, the need for reliable refrigeration in sectors like food and beverage, pharmaceuticals, and logistics becomes paramount. This trend is expected to bolster the market, with significant investments in infrastructure and technology. The growing middle class in these regions further amplifies the demand for refrigeration, suggesting a sustained upward trajectory for insulation materials.

Growing Demand for Energy Efficiency

The Global Refrigeration Insulation Materials Market Industry is experiencing a notable surge in demand driven by the increasing emphasis on energy efficiency. As industries and consumers alike seek to reduce energy consumption, insulation materials play a crucial role in minimizing thermal losses. This trend is particularly evident in commercial refrigeration systems, where effective insulation can lead to substantial energy savings. The market is projected to reach 3.7 USD Billion in 2024, reflecting a growing awareness of energy-efficient solutions. Furthermore, the anticipated growth in this sector aligns with global sustainability goals, suggesting that the demand for advanced insulation materials will continue to rise.

Increased Focus on Cold Chain Logistics

The Global Refrigeration Insulation Materials Market Industry is poised for growth due to the heightened focus on cold chain logistics. As global trade expands, the need for efficient temperature-controlled supply chains becomes critical, particularly in the food and pharmaceutical sectors. Effective insulation materials are essential for maintaining the integrity of temperature-sensitive products during transit. This trend is further supported by the increasing consumer demand for fresh and safe products, which drives investments in cold chain infrastructure. The market's growth is likely to be robust, as stakeholders recognize the importance of insulation in ensuring product quality and compliance with safety standards.

Regulatory Support for Environmental Standards

The Global Refrigeration Insulation Materials Market Industry benefits significantly from stringent environmental regulations aimed at reducing greenhouse gas emissions. Governments worldwide are implementing policies that mandate the use of environmentally friendly insulation materials, thereby fostering market growth. For instance, regulations that promote the use of low-global warming potential (GWP) materials are becoming more prevalent. This regulatory landscape encourages manufacturers to innovate and develop sustainable insulation solutions. As a result, the market is likely to expand, with projections indicating a growth trajectory that could see it reach 6.38 USD Billion by 2035, driven by compliance with these environmental standards.

Technological Advancements in Insulation Materials

Innovations in insulation technology are significantly influencing the Global Refrigeration Insulation Materials Market Industry. The development of advanced materials, such as aerogels and vacuum insulation panels, offers superior thermal performance compared to traditional options. These advancements not only enhance energy efficiency but also contribute to space-saving designs in refrigeration applications. As manufacturers adopt these cutting-edge technologies, the market is expected to witness robust growth. The anticipated compound annual growth rate (CAGR) of 5.09% from 2025 to 2035 underscores the potential for technological innovations to reshape the market landscape, making it more competitive and efficient.