Middle East Insulation Materials Market Summary

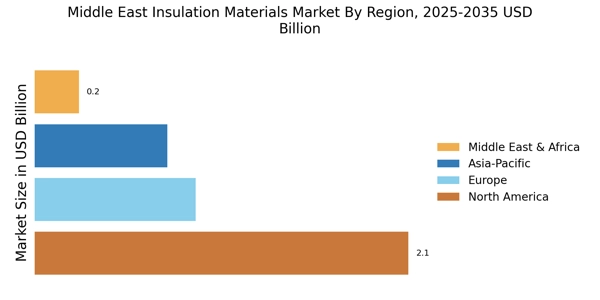

As per Market Research Future analysis, the Middle East Insulation Materials Market Size was valued at USD 3,026.2 million in 2024. The Middle East Insulation Materials Market is projected to grow from USD 3,143.9 million in 2025 to USD 4,466.6 million by 2035, exhibiting a compound annual growth rate (CAGR) of 3.574% during the forecast period (2025 – 2035).

Key Market Trends & Highlights

Middle East insulation materials market reflects accelerating growth amid sustainability mandates, construction surges, and technological shifts:

- Advanced foams like PIR and PU offer superior R-values, minimizing HVAC loads in scorching summers. Aerogels and vacuum-insulated panels emerge for high-end applications, providing thin yet effective barriers.

- Mega-projects like NEOM and Qatar's post-World Cup developments fuel residential and commercial demand, with insulation comprising 5-7% of material costs. Industrial sectors, including oil & gas, prioritize high-temperature solutions for pipelines and tanks.

- Sensors-embedded insulation monitors thermal performance in real-time, optimizing energy use in smart cities like Dubai's initiatives. IoT-enabled systems predict failures in industrial applications.

- Bio-based insulators from agricultural waste, such as date palm fibers, localize supply and slash emissions. Modular prefabricated panels with reusable insulation support deconstruction in temporary structures.

Market Size & Forecast

| 2024 Market Size | 3,026.2 (USD Million) |

| 2035 Market Size | 4,466.6 (USD Million) |

| CAGR (2025 - 2035) | 3.574% |

Major Players

BASF SE, Knauf Insulation, Kingspan Group, Rockwool International A/S, Saint-Gobain, Covestro, Huntsman International LLC, DuPont, DOW, AFICO, and Others.