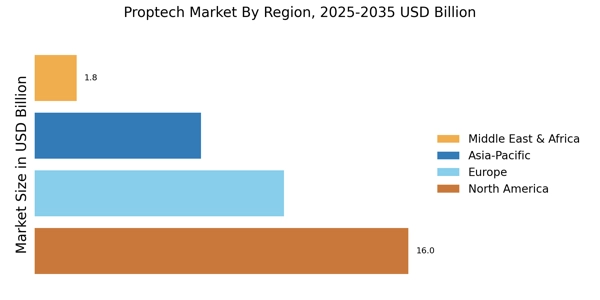

North America : Innovation and Market Leadership

North America is the largest market for Proptech Market, holding approximately 45% of the global share, driven by technological advancements and a strong demand for digital real estate solutions. The region benefits from a robust regulatory framework that encourages innovation, particularly in the U.S. and Canada. The increasing adoption of AI and blockchain technologies is further propelling market growth, with a focus on enhancing user experience and operational efficiency. The U.S. is the leading country in this sector, home to major players like Zillow, Opendoor, and Redfin. Canada follows closely, with a growing number of startups entering the market. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. The presence of significant investment in technology and real estate sectors continues to attract new entrants, fostering a dynamic environment.

The Argentina proptech market is set for strong growth through 2035, with rising digital platform use and analytics‑driven tools enhancing real estate transactions and management across both residential and commercial segments.

Europe : Emerging Market with Growth Potential

Europe is witnessing a rapid growth in the Proptech Market, currently holding about 30% of the global share. The region's growth is fueled by increasing urbanization, a shift towards digital solutions in real estate, and supportive government policies aimed at innovation. Countries like Germany and the UK are leading this transformation, with a focus on sustainability and smart city initiatives that are reshaping the real estate landscape. Germany stands out as a key player, with a strong presence of Proptech Market startups and established companies. The UK follows closely, with significant investments in technology-driven real estate solutions. The competitive landscape is vibrant, with numerous players like PropertyNest and LendInvest making strides. The European market is characterized by collaboration between tech firms and traditional real estate companies, enhancing service offerings and customer engagement. The France proptech market is witnessing strong digital transformation across residential and commercial real estate segments.

A strong digital transformation is taking place within the France PropTech market, with anticipated continued growth until 2035, as digital platforms and smart technology impact property management and consumer experience in the residential and commercial real estate sectors.

Asia-Pacific : Rapid Growth and Investment

Asia-Pacific is rapidly emerging as a significant player in the Proptech Market, currently accounting for approximately 20% of the global share. The region's growth is driven by increasing urbanization, a tech-savvy population, and rising investment in digital real estate solutions. Countries like China and India are at the forefront, with government initiatives promoting smart cities and digital infrastructure, which are crucial for Proptech Market development. China leads the market with a plethora of Proptech Market startups and established companies leveraging technology to enhance real estate transactions. India is also witnessing a surge in Proptech Market investments, with a growing number of platforms catering to diverse real estate needs. The competitive landscape is marked by innovation, with local players adapting global trends to meet regional demands, creating a dynamic environment for growth. The APAC proptech market is experiencing rapid growth, driven by urbanization, smart city initiatives, and rising digital adoption.

The Asia-Pacific proptech market is experiencing a tremendous boom and is expected to have dramatic growth levels between 2025 and 2035 due to the increases in the Real Estate Industry's digital migration, China, and other growing Asian Economies. The increase in investments into both Smart Technology and Sustainability Solutions across property types in this region will driven growth in this sector.

Middle East and Africa : Untapped Potential and Growth

The Middle East and Africa region is gradually emerging in the Proptech Market, currently holding about 5% of the global share. The growth is primarily driven by increasing urbanization, a young population, and a growing interest in digital solutions for real estate. Countries like the UAE and South Africa are leading the charge, with government initiatives aimed at enhancing the real estate sector through technology and innovation. The UAE is a key player, with a strong focus on smart city projects and digital transformation in real estate. South Africa is also witnessing growth, with several startups entering the Proptech Market space. The competitive landscape is evolving, with both local and international players seeking to capitalize on the untapped potential in the region, fostering a vibrant ecosystem for Proptech Market development. The GCC proptech market is expanding steadily, supported by smart city projects and investments in digital infrastructure.

Between 2025 and 2035, a significant growth in PropTech can be expected in the Gulf Cooperation Council (GCC) due to an overall demand for technological-based solutions for the real estate industry (PropTech) and more investment in digital infrastructure that is intelligent and sustainable from the major economies within the Gulf region.