Expansion of Remote Work Trends

The ongoing expansion of remote work trends is reshaping the proptech market in Canada. As more companies adopt flexible work arrangements, there is a growing demand for residential properties that accommodate home offices and collaborative spaces. This shift is influencing property design and location preferences, with urban areas experiencing a decline in demand while suburban and rural properties gain traction. Data suggests that nearly 40% of Canadians now prefer homes with dedicated workspaces, prompting developers to adapt their offerings. This evolving landscape presents opportunities for innovation within the proptech market.

Increased Focus on Cybersecurity

As the proptech market in Canada continues to digitize, the focus on cybersecurity is intensifying. With the rise of digital platforms for property transactions, safeguarding sensitive data has become paramount. Stakeholders are increasingly investing in robust cybersecurity measures to protect against potential breaches and maintain consumer trust. Recent statistics indicate that cyberattacks in the real estate sector have surged by 25% over the past year. This heightened awareness is driving the development of secure platforms and technologies, which are essential for the continued growth and stability of the proptech market.

Integration of Artificial Intelligence

Artificial Intelligence (AI) is becoming a pivotal driver in the proptech market, particularly in Canada. AI technologies are being utilized to enhance property management, streamline transactions, and improve customer experiences. For instance, AI-driven analytics can predict market trends and optimize pricing strategies, which is crucial for investors and developers. Reports indicate that AI adoption in real estate could lead to a 20% increase in operational efficiency. As AI continues to evolve, its integration into the proptech market is likely to reshape traditional practices, making it a key area of focus for stakeholders.

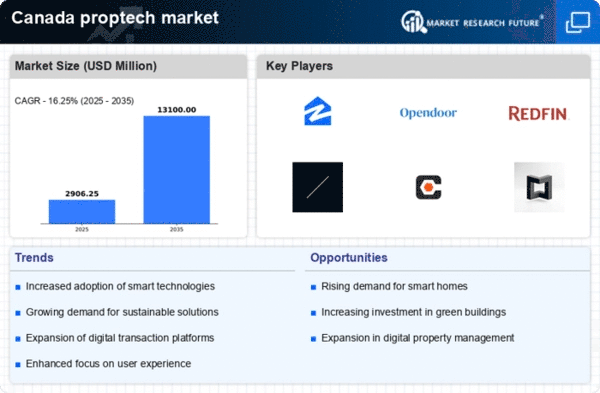

Rising Demand for Sustainable Solutions

The proptech market in Canada is experiencing a notable shift towards sustainability, driven by increasing consumer awareness and regulatory pressures. As environmental concerns gain prominence, property developers and investors are prioritizing eco-friendly technologies. This trend is reflected in the growing adoption of energy-efficient systems and green building certifications. According to recent data, approximately 30% of new residential projects in Canada now incorporate sustainable practices. This shift not only enhances property value but also aligns with the preferences of environmentally conscious buyers, thereby propelling the growth of the proptech market.

Government Incentives for Technology Adoption

Government initiatives aimed at promoting technology adoption are significantly impacting the proptech market in Canada. Various programs and incentives are being introduced to encourage the integration of digital solutions in real estate transactions and property management. For example, grants and tax credits for adopting smart technologies are becoming more prevalent. These incentives not only lower the financial barriers for property developers but also stimulate innovation within the sector. As a result, the proptech market is likely to see accelerated growth as stakeholders leverage these opportunities to enhance operational efficiency and customer engagement.