Proptech Size

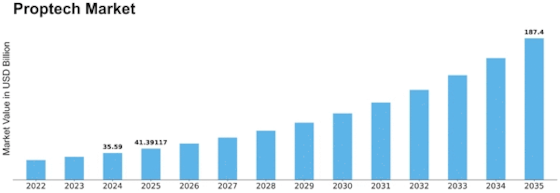

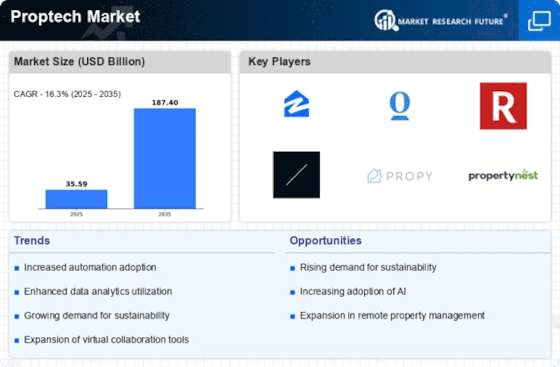

Proptech Market Growth Projections and Opportunities

The Proptech market, a unique area at the crossing point of land and innovation, is impacted by a heap of market factors that shape its development and direction. One of the urgent elements is the rising urbanization pattern across the globe. As additional individuals move to metropolitan regions, the interest in productive and creative arrangements in land the executives and exchanges heightens. Proptech, with its attention on utilizing innovation to improve different aspects of the land business, is strategically set up to address these metropolitan difficulties.

Besides, the quick progression of innovation itself is a main impetus in the Proptech market. Developments like man-made reasoning, blockchain, and the Web of Things (IoT) are changing the conventional land scene. These advances empower robotization, information examination, and savvy building arrangements, offering another degree of productivity and straightforwardness in property the executives. The Proptech market is expanding because real estate sector stakeholders and investors are increasingly recognizing the potential of these technological advancements.

Another critical market factor is the rising mindfulness and reception of supportability rehearses in land. With a developing accentuation on ecological cognizance, Proptech arrangements that advance energy proficiency, reasonable development practices, and smart asset the board are building up forward momentum. Financial backers and buyers the same are focusing on properties and advancements that line up with eco-accommodating standards, in this manner driving the mix of manageability centered Proptech arrangements.

Unofficial laws and strategies likewise assume a vital part in molding the Proptech market. Administrative systems connected with information security, property exchanges, and innovation reception can either cultivate or thwart the development of Proptech organizations. Market players need to explore and agree with these guidelines, which might change across various locales, affecting the reception and versatility of Proptech arrangements.

The developing shopper conduct and assumptions are extra factors affecting the Proptech market. Present day shoppers, acquainted with consistent advanced encounters in different parts of their lives, request a similar degree of comfort and proficiency in land exchanges. Proptech organizations that offer easy to understand stages, virtual property visits, and smoothed out processes gain an upper hand in gathering the developing requirements of the present educated purchasers.

Venture patterns and financing elements contribute altogether to the Proptech market's development. As the area keeps on exhibiting its true capacity, financial backers are showing expanded interest, infusing capital into Proptech new businesses, and laid out organizations. This convergence of assets powers innovative work, advancement, and market extension, pushing the Proptech market forward.

The flexibility and versatility of the land business itself despite financial changes and worldwide occasions influence the Proptech market. The Coronavirus pandemic, for example, sped up the reception of remote work, affecting inclinations for private and business properties. Proptech arrangements that address these evolving needs, for example, virtual coordinated effort apparatuses and advanced property the board stages, experienced increased request during such occasions.

Leave a Comment