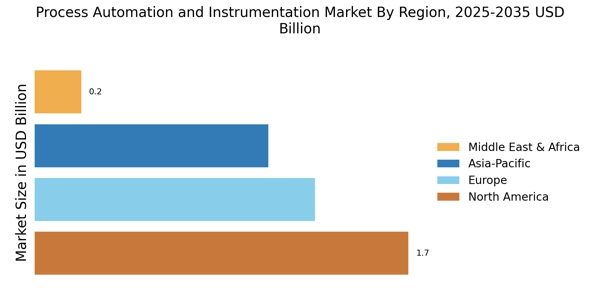

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. North America Process Automation and Instrumentation market accounted for USD 1.7 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. The United States is famous for its capacity for innovation and is leading important advancements in the cutting-edge technologies of the Fourth Industrial Revolution.

Further, the major countries studied in the Process Automation and Instrumentation Market report are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe Process Automation and Instrumentation market account for the second-largest market share during the forecast period in 2022. The demand for Process Automation and Instrumentation Market in the region is anticipated to be driven by the growing need for improved operational efficiency, higher safety, and new technological advancements. The EU's most automated economy is found in Germany. There are about 230,000 industrial robots in operation in Germany. In 2020, only 22,300 new units were put in place.

As a result, German industries use around three times as many industrial robots as Italian factories (78,200 units as of 2021), five times as many as French factories (44,800 units as of 2021), and ten times as much as UK factories (23,000 units as of 2021). Further, the Germany Process Automation and Instrumentation market held the largest market share, and the UK Process Automation and Instrumentation market was the fastest-growing market in the European region

The Asia-Pacific Process Automation and Instrumentation Market are expected to grow at the fastest CAGR from 2024 to 2032. This is due to increasing focus of government programs to promote automated technologies, extensive domestic manufacturing, and information technology development. Moreover, China Process Automation and Instrumentation market held the largest market share, and the India Process Automation and Instrumentation market was the fastest-growing market in the Asia-Pacific region

For instance, India Process Automation and Instrumentation market will grow with the fastest-growing CAGR in the Asia Pacific region during the forecast period. The process automation and instrumentation market is expanding significantly due to industrial companies' increased focus on cost reduction and improved efficiency. The process automation and instrumentation industry is expanding due to increased productivity and reduced mistake rates. The post by Gesrepair claims that manufacturing companies worldwide are investing in modern manufacturing technologies and making wise decisions to enhance their production process.

Hence, the global process automation and instrumentation market is expanding as industrial companies emphasize attaining cost savings and greater efficiency.