Rising Demand for Efficiency

The US Process Automation Instrumentation Market is experiencing a notable surge in demand for enhanced operational efficiency. Industries are increasingly adopting automation solutions to streamline processes, reduce operational costs, and improve productivity. According to recent data, companies that implement process automation can achieve efficiency gains of up to 30%. This trend is particularly evident in sectors such as manufacturing and oil and gas, where automation technologies are being integrated to optimize production lines and reduce downtime. As organizations strive to remain competitive, the focus on efficiency is likely to drive further investments in process automation instrumentation.

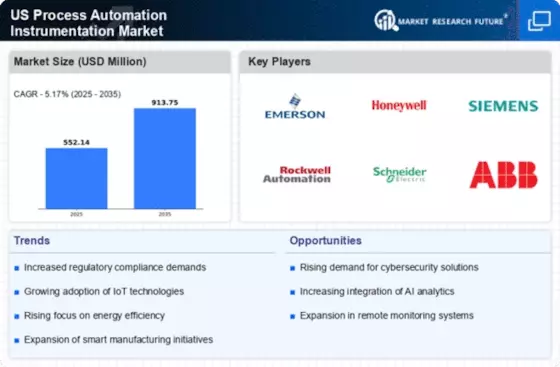

Technological Advancements in Automation

Technological advancements are significantly influencing the US Process Automation Instrumentation Market. Innovations such as artificial intelligence, machine learning, and advanced analytics are being integrated into automation systems, enabling real-time data processing and decision-making. This evolution allows for more precise control and monitoring of industrial processes. For example, the adoption of AI-driven analytics can lead to a reduction in operational costs by up to 25%. As these technologies continue to evolve, they are likely to enhance the capabilities of process automation instrumentation, making it a vital component for industries aiming to optimize their operations.

Regulatory Compliance and Safety Standards

In the US Process Automation Instrumentation Market, adherence to regulatory compliance and safety standards is a critical driver. Industries such as pharmaceuticals and food processing are subject to stringent regulations that necessitate the use of advanced automation technologies. The implementation of process automation instrumentation not only aids in meeting these regulatory requirements but also enhances safety protocols. For instance, the Food and Drug Administration (FDA) mandates specific automation standards to ensure product quality and safety. As compliance becomes increasingly complex, the demand for sophisticated automation solutions is expected to rise, further propelling market growth.

Increased Investment in Smart Manufacturing

The trend towards smart manufacturing is a prominent driver in the US Process Automation Instrumentation Market. As manufacturers seek to leverage Industry 4.0 principles, there is a growing emphasis on integrating automation technologies with IoT and data analytics. This shift is expected to enhance production efficiency and flexibility. According to industry reports, investments in smart manufacturing technologies are projected to reach $400 billion by 2025 in the US alone. This influx of capital is likely to stimulate demand for advanced process automation instrumentation, as companies aim to modernize their operations and improve overall competitiveness.

Focus on Sustainability and Energy Efficiency

Sustainability initiatives are increasingly shaping the US Process Automation Instrumentation Market. Companies are under pressure to reduce their carbon footprint and enhance energy efficiency. Automation technologies play a crucial role in achieving these sustainability goals by optimizing resource usage and minimizing waste. For instance, process automation can lead to energy savings of up to 20% in manufacturing operations. As organizations prioritize sustainable practices, the demand for process automation instrumentation that supports these initiatives is expected to grow, driving innovation and investment in the sector.