Expansion of Mining Activities

The Geotechnical Instrumentation and Monitoring Market is also benefiting from the expansion of mining activities across various regions. As mining operations become more extensive and complex, the need for effective geotechnical monitoring solutions is paramount. These solutions help in assessing ground stability, predicting landslides, and ensuring the safety of mining personnel. The mining sector is projected to grow at a compound annual growth rate of around 4% in the coming years, driven by the increasing demand for minerals and resources. This growth is likely to stimulate investments in geotechnical instrumentation, as companies seek to mitigate risks associated with mining operations. The integration of advanced monitoring technologies in mining is expected to enhance operational efficiency and safety, further propelling the market.

Rising Awareness of Safety Standards

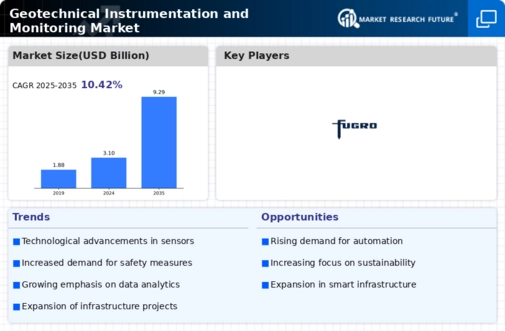

The Geotechnical Instrumentation and Monitoring Market is significantly influenced by the rising awareness of safety standards in construction and engineering projects. Stakeholders are increasingly recognizing the importance of monitoring geotechnical conditions to prevent accidents and ensure compliance with safety regulations. This heightened awareness is leading to the adoption of advanced monitoring technologies, such as automated sensors and real-time data analytics. As a result, the market for geotechnical instrumentation is expected to expand, with a projected growth rate of around 6% annually. Companies are investing in innovative solutions that provide accurate and timely data, which is essential for making informed decisions during construction. This trend underscores the critical role of geotechnical monitoring in enhancing safety and minimizing risks associated with construction activities.

Increasing Infrastructure Development

The Geotechnical Instrumentation and Monitoring Market is experiencing a surge due to the increasing demand for infrastructure development. Governments and private sectors are investing heavily in construction projects, including roads, bridges, and tunnels. This trend is driven by urbanization and the need for improved transportation networks. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. As infrastructure projects become more complex, the need for precise geotechnical monitoring solutions becomes paramount. These solutions help in assessing soil stability, groundwater levels, and structural integrity, thereby ensuring safety and efficiency in construction activities. Consequently, the growth in infrastructure development is likely to propel the demand for geotechnical instrumentation and monitoring solutions.

Growing Demand for Environmental Monitoring

The Geotechnical Instrumentation and Monitoring Market is increasingly driven by the growing demand for environmental monitoring. As environmental concerns become more pronounced, there is a pressing need for monitoring solutions that assess the impact of construction activities on surrounding ecosystems. This includes monitoring soil erosion, groundwater contamination, and the stability of natural slopes. The market is expected to grow by approximately 5% as regulatory bodies impose stricter environmental guidelines. Companies are now required to implement comprehensive monitoring systems to ensure compliance with these regulations. This trend not only enhances environmental protection but also promotes sustainable construction practices. Consequently, the demand for geotechnical instrumentation that can provide accurate environmental data is likely to rise.

Technological Innovations in Monitoring Solutions

The Geotechnical Instrumentation and Monitoring Market is witnessing a wave of technological innovations that are transforming monitoring solutions. Advancements in sensor technology, data analytics, and remote monitoring systems are enabling more accurate and efficient geotechnical assessments. For instance, the integration of IoT (Internet of Things) in geotechnical instrumentation allows for real-time data collection and analysis, enhancing decision-making processes. The market is projected to grow at a rate of approximately 7% as these technologies become more accessible and affordable. Furthermore, the development of smart monitoring systems that can predict potential failures or hazards is likely to drive further adoption. This trend indicates a shift towards more proactive approaches in geotechnical monitoring, ultimately improving project outcomes and safety.