Rising Livestock Production

The rising livestock production across various regions is a significant driver for the Probiotics in animal feed Market. As the global population continues to grow, the demand for meat, dairy, and other animal products is expected to rise correspondingly. This increase in production necessitates the use of effective feed additives, such as probiotics, to ensure optimal growth rates and health in livestock. Recent data indicates that the livestock sector is projected to expand by 5% annually, creating a substantial market for probiotics. Consequently, the integration of these beneficial microorganisms into animal feed is becoming a standard practice among producers aiming to meet the escalating demand for high-quality animal products.

Regulatory Support for Probiotic Use

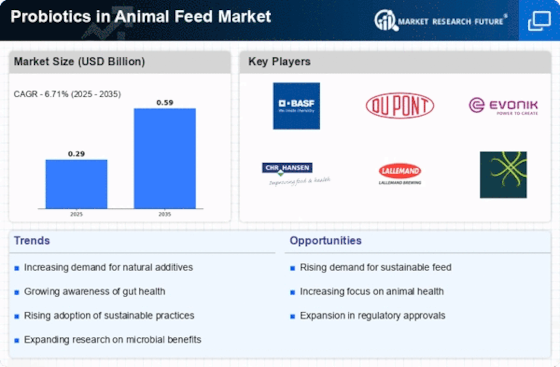

Regulatory bodies are increasingly recognizing the benefits of probiotics in animal feed, which serves as a significant driver for the Probiotics in Animal Feed Market. Various countries have established guidelines and frameworks that support the use of probiotics as safe and effective feed additives. This regulatory backing not only enhances consumer confidence but also encourages manufacturers to innovate and expand their product offerings. For instance, the approval of specific probiotic strains for use in livestock feed has been observed in several regions, contributing to a market growth rate that could reach 8% annually. As regulations evolve, the market is likely to witness a surge in the adoption of probiotics, further solidifying their role in animal nutrition.

Increasing Awareness of Animal Health

The growing awareness regarding animal health and nutrition is a pivotal driver in the Probiotics in Animal Feed Market. As consumers become more informed about the benefits of probiotics, livestock producers are increasingly adopting these additives to enhance animal well-being. This trend is reflected in the rising demand for high-quality animal products, which has led to a projected growth rate of approximately 7% in the probiotics segment. The emphasis on health benefits, such as improved digestion and enhanced immune response, is likely to propel the market further. Consequently, the integration of probiotics into animal feed is seen as a proactive measure to ensure optimal health and productivity in livestock, thereby influencing purchasing decisions across the industry.

Shift Towards Sustainable Farming Practices

The shift towards sustainable farming practices is a crucial driver in the Probiotics in Animal Feed Market. As environmental concerns escalate, farmers are increasingly seeking alternatives to conventional feed additives that may have adverse effects on animal health and the ecosystem. Probiotics offer a natural solution, promoting gut health and reducing the need for antibiotics. This transition aligns with the growing consumer preference for sustainably sourced animal products, which is projected to increase market demand by approximately 6% over the next few years. By integrating probiotics into animal feed, producers can enhance sustainability while maintaining productivity, thus appealing to a broader audience concerned with ethical farming practices.

Technological Innovations in Probiotic Formulations

Technological innovations in probiotic formulations are emerging as a key driver in the Probiotics in Animal Feed Market. Advances in biotechnology and microbiology have led to the development of more effective and stable probiotic strains, enhancing their efficacy in animal nutrition. These innovations not only improve the delivery and viability of probiotics in feed but also allow for tailored solutions that meet specific animal health needs. The market is witnessing a trend towards customized probiotic formulations, which could potentially increase market growth by 9% in the coming years. As producers seek to optimize animal health and productivity, the role of advanced probiotic technologies is likely to become increasingly prominent.