Market Trends

Introduction

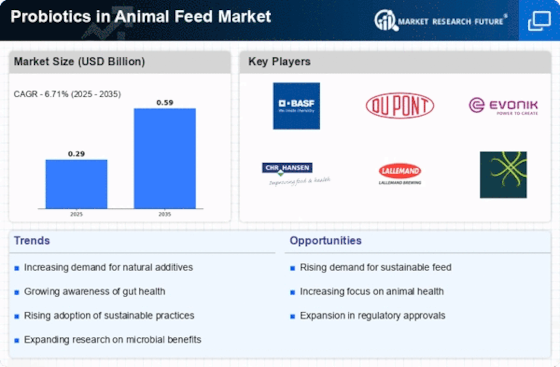

As we enter 2024, the Probiotics in Animal Feed Market is experiencing significant transformation driven by a confluence of macro factors. Technological advancements in fermentation processes and genetic engineering are enhancing the efficacy and application of probiotics in livestock nutrition. Concurrently, regulatory pressures are intensifying, with governments and industry bodies advocating for sustainable and health-oriented animal husbandry practices. Additionally, shifts in consumer behavior, particularly the growing demand for organic and antibiotic-free animal products, are compelling stakeholders to innovate and adapt their offerings. These trends are strategically important for stakeholders as they navigate a rapidly evolving landscape, ensuring compliance, meeting consumer expectations, and leveraging new technologies to maintain competitive advantage.

Top Trends

-

Increased Demand for Natural Feed Additives

There is a growing preference for natural over synthetic additives in animal feed, driven by consumer demand for organic products. Industry leaders are responding by developing probiotic formulations that meet these criteria. For instance, ADM has launched a range of natural probiotic solutions that align with this trend. This shift is expected to enhance product appeal and market competitiveness, leading to increased adoption rates among livestock producers. -

Regulatory Support for Probiotic Use

Governments are increasingly recognizing the benefits of probiotics in animal health, leading to supportive regulations. The European Union has implemented guidelines that facilitate the approval of probiotic strains for animal feed. This regulatory backing is likely to encourage more companies to invest in research and development, potentially expanding the range of available probiotic products in the market. -

Focus on Gut Health and Animal Welfare

There is a heightened focus on gut health as a critical factor in animal welfare and productivity. Companies like Kemin Industries are emphasizing the role of probiotics in enhancing gut microbiota. Research indicates that probiotics can reduce the incidence of gastrointestinal diseases in livestock, which can lead to improved growth rates and feed efficiency, thereby positively impacting overall production costs. -

Technological Advancements in Probiotic Delivery Systems

Innovations in delivery systems for probiotics are enhancing their efficacy and stability in animal feed. For example, encapsulation technologies are being developed to protect probiotics from heat and moisture. This advancement is crucial for maintaining the viability of probiotics during storage and feeding, which can lead to better health outcomes for animals and increased market acceptance. -

Sustainability and Environmental Impact

Sustainability is becoming a key driver in the animal feed sector, with probiotics being recognized for their potential to reduce environmental footprints. Probiotics can improve nutrient absorption, thereby decreasing waste output. Companies like Nutreco are actively promoting these benefits, which may lead to a shift in consumer preferences towards more sustainable feed options, influencing market dynamics. -

Integration of Probiotics in Aquaculture

The aquaculture sector is increasingly adopting probiotics to enhance fish health and growth. Research shows that probiotics can improve water quality and reduce disease outbreaks in aquaculture systems. Industry players are investing in tailored probiotic solutions for aquatic species, which could lead to significant growth opportunities in this segment of the market. -

Personalized Nutrition for Livestock

The trend towards personalized nutrition is gaining traction, with probiotics being tailored to specific animal needs. Companies are leveraging data analytics to create customized probiotic blends that address individual health challenges. This approach is expected to enhance animal performance and welfare, potentially leading to higher profitability for producers. -

Collaboration and Partnerships in Research

Collaborative efforts between academia and industry are driving innovation in probiotic research. Partnerships are being formed to explore new probiotic strains and their applications in animal feed. This collaborative approach is likely to accelerate the development of effective probiotic solutions, enhancing the overall market landscape and fostering competitive advantages. -

Consumer Awareness and Education

There is a growing awareness among consumers regarding the benefits of probiotics in animal feed, influencing purchasing decisions. Educational campaigns by industry leaders are helping to inform stakeholders about the advantages of probiotics for animal health. This trend is expected to drive demand for probiotic-enhanced products, impacting market growth positively. -

Global Expansion of Probiotic Products

The global market for probiotics in animal feed is witnessing expansion as companies explore new geographic regions. Emerging markets are showing increased interest in probiotic solutions due to rising livestock production. This trend is likely to lead to strategic investments and market entry by key players, further diversifying the product offerings available to consumers.

Conclusion: Navigating the Probiotics Market Landscape

The Probiotics in Animal Feed Market is characterized by intense competitive dynamics and significant fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a growing demand for sustainable and high-quality feed solutions, prompting vendors to innovate and adapt their offerings. Legacy players are leveraging established distribution networks and brand loyalty, while emerging companies are focusing on advanced capabilities such as AI-driven formulations and automation in production processes. As the market evolves, the ability to integrate sustainability and flexibility into product development will be crucial for leadership. Vendors that prioritize these capabilities will not only enhance their competitive positioning but also align with the increasing regulatory and consumer demands for responsible animal husbandry practices.

Leave a Comment