Market Analysis

Probiotics in Animal Feed Market (Global, 2024)

Introduction

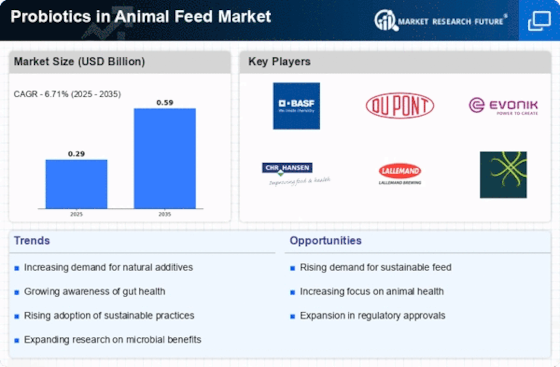

The Probiotics in Animal Feed Market is experiencing a significant transformation as the demand for sustainable and health-oriented livestock production continues to rise. Probiotics, which are live microorganisms that confer health benefits to the host, are increasingly being recognized for their role in enhancing animal health, improving feed efficiency, and promoting overall growth performance in livestock. This market is driven by a growing awareness among farmers and producers about the advantages of incorporating probiotics into animal diets, particularly in the context of reducing reliance on antibiotics and addressing consumer concerns regarding food safety and quality. Additionally, the increasing prevalence of zoonotic diseases and the need for improved animal welfare standards are further propelling the adoption of probiotic solutions in animal husbandry. As the industry evolves, innovations in probiotic formulations and delivery methods are expected to play a crucial role in shaping the future landscape of animal nutrition, making it imperative for stakeholders to stay informed about emerging trends and regulatory developments within this dynamic market.

PESTLE Analysis

- Political

- In 2024, the regulatory landscape for probiotics in animal feed is heavily influenced by government policies aimed at enhancing food safety and animal health. The European Union has implemented strict regulations, with the European Food Safety Authority (EFSA) requiring that all probiotics used in animal feed must undergo rigorous safety assessments, which can cost up to €100,000 per product. Additionally, the U.S. Department of Agriculture (USDA) has increased funding for research on probiotics, allocating approximately $5 million in grants to support studies that demonstrate the efficacy of these additives in livestock production.

- Economic

- The economic environment for the probiotics in animal feed market is shaped by rising feed costs and the increasing demand for sustainable livestock production. In 2024, the average cost of animal feed is projected to reach $300 per ton, which has prompted farmers to seek cost-effective alternatives like probiotics that can enhance feed efficiency. Furthermore, the global livestock sector is expected to employ over 1.5 billion people, highlighting the economic significance of this market as it supports livelihoods and contributes to food security.

- Social

- Consumer awareness regarding animal welfare and the health benefits of probiotics is on the rise, influencing purchasing decisions in the animal feed market. In 2024, surveys indicate that 65% of consumers are willing to pay a premium for products derived from animals fed with probiotics, reflecting a growing trend towards healthier and more sustainable food sources. This shift in consumer behavior is driving manufacturers to incorporate probiotics into their feed formulations to meet the demand for higher quality animal products.

- Technological

- Advancements in biotechnology are playing a crucial role in the development of innovative probiotic strains for animal feed. In 2024, research institutions and companies are investing approximately $200 million in R&D to enhance the efficacy and stability of probiotics. Technologies such as encapsulation and microencapsulation are being utilized to improve the delivery of probiotics in the gastrointestinal tract of animals, ensuring higher survival rates and better health outcomes.

- Legal

- The legal framework governing the use of probiotics in animal feed is becoming increasingly stringent. In 2024, the U.S. Food and Drug Administration (FDA) has established new guidelines that require all probiotic products to be registered and labeled with specific health claims, which can incur compliance costs of around $50,000 per product. Additionally, countries like Canada are enforcing similar regulations, mandating that all probiotics must be approved before they can be marketed, thereby ensuring consumer safety and product efficacy.

- Environmental

- The environmental impact of probiotics in animal feed is gaining attention as the livestock industry seeks to reduce its carbon footprint. In 2024, studies show that the use of probiotics can decrease methane emissions from ruminants by up to 20%, contributing to climate change mitigation efforts. Furthermore, the adoption of probiotics is linked to improved nutrient absorption, which can lead to a reduction in the overall environmental load of animal waste, thereby promoting more sustainable farming practices.

Porter's Five Forces

- Threat of New Entrants

- Medium - The probiotics in animal feed market has moderate barriers to entry due to the need for specialized knowledge and technology in fermentation and microbiology. While the market is growing, established players have significant brand loyalty and distribution networks, which can deter new entrants. However, the increasing demand for natural and health-oriented animal feed products may attract new companies looking to capitalize on this trend.

- Bargaining Power of Suppliers

- Low - The bargaining power of suppliers in the probiotics for animal feed market is relatively low. There are numerous suppliers of raw materials and probiotic strains, which creates a competitive environment. Additionally, many companies can source ingredients from multiple suppliers, reducing dependency on any single supplier and allowing for better negotiation terms.

- Bargaining Power of Buyers

- High - Buyers in the probiotics in animal feed market, including large-scale livestock producers and feed manufacturers, have significant bargaining power. They often purchase in bulk and can switch suppliers easily, which puts pressure on manufacturers to offer competitive pricing and high-quality products. The increasing awareness of animal health and nutrition also empowers buyers to demand better formulations and efficacy from suppliers.

- Threat of Substitutes

- Medium - The threat of substitutes in the probiotics in animal feed market is moderate. While probiotics offer specific health benefits for animals, alternative feed additives such as prebiotics, enzymes, and traditional antibiotics can serve similar purposes. However, the growing trend towards natural and organic farming practices may limit the appeal of synthetic substitutes, thereby supporting the probiotics market.

- Competitive Rivalry

- High - Competitive rivalry in the probiotics in animal feed market is high, with several established players and new entrants vying for market share. Companies are investing in research and development to innovate and differentiate their products, leading to aggressive marketing strategies. The increasing focus on animal welfare and health further intensifies competition as firms strive to meet evolving consumer demands.

SWOT Analysis

Strengths

- Increasing awareness of animal health and nutrition among farmers and livestock producers.

- Probiotics enhance feed efficiency and improve animal growth rates.

- Growing demand for organic and natural feed additives in the livestock industry.

Weaknesses

- High production costs associated with probiotic formulations.

- Limited awareness and understanding of probiotics among some farmers.

- Regulatory challenges and varying standards across different regions.

Opportunities

- Expansion of the aquaculture sector driving demand for probiotics.

- Rising consumer preference for antibiotic-free meat products.

- Potential for innovation in probiotic strains and delivery methods.

Threats

- Intense competition from alternative feed additives and supplements.

- Economic fluctuations affecting livestock production and feed costs.

- Potential backlash against probiotics due to lack of scientific consensus on efficacy.

Summary

The Probiotics in Animal Feed Market in 2024 is characterized by strong growth potential driven by increasing awareness of animal health and a shift towards natural feed additives. However, challenges such as high production costs and regulatory hurdles may hinder market expansion. Opportunities exist in the growing aquaculture sector and the rising demand for antibiotic-free products, while competition and economic factors pose significant threats. Strategic focus on education and innovation will be crucial for stakeholders to capitalize on these trends.

Leave a Comment