Market Share

Introduction: Navigating the Competitive Landscape of Probiotics in Animal Feed

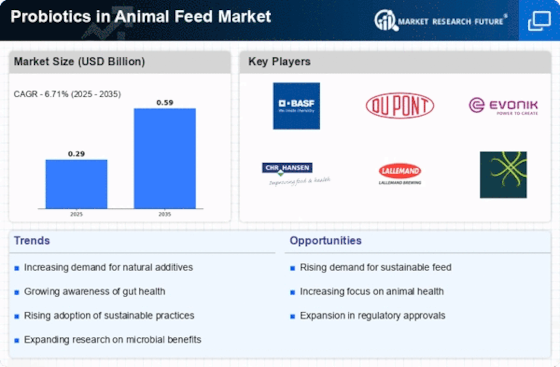

The probiotics in animal feed market is experiencing unprecedented competitive momentum, driven by rapid technology adoption, evolving regulatory frameworks, and heightened consumer expectations for sustainable livestock practices. Key players, including established OEMs, innovative IT integrators, and emerging biotech startups, are vying for market leadership by leveraging advanced technologies such as AI-based analytics and IoT-enabled solutions. These differentiators not only enhance product efficacy but also optimize supply chain efficiencies, thereby reshaping vendor positioning. As the industry shifts towards green infrastructure and biometrics for livestock health monitoring, regional growth opportunities are emerging, particularly in North America and Asia-Pacific, where strategic deployment trends are focused on enhancing feed quality and animal welfare. Executives must remain vigilant to these dynamics to capitalize on the transformative potential of probiotics in animal nutrition.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions encompassing various aspects of probiotics in animal feed.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| ADM | Diverse product portfolio and expertise | Animal nutrition and health | Global |

| Cargill | Strong supply chain and innovation | Animal feed and nutrition | North America, Europe, Asia |

| Nutreco | Focus on sustainable animal nutrition | Animal feed solutions | Global |

| Alltech | Research-driven product development | Animal health and nutrition | Global |

Specialized Technology Vendors

These vendors focus on specific probiotic technologies and formulations tailored for animal feed.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Kemin Industries | Innovative ingredient solutions | Animal health and nutrition | Global |

| Biomin | Expertise in mycotoxin management | Probiotics and feed additives | Global |

| Lallemand | Strong fermentation technology | Probiotics and yeast products | Global |

| Hansen | Focus on microbial solutions | Probiotics for animal feed | Global |

Infrastructure & Equipment Providers

These vendors provide the necessary infrastructure and equipment for the production and application of probiotics in animal feed.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Evonik Industries | Advanced production technologies | Specialty chemicals and additives | Global |

| BASF | Broad chemical expertise | Feed additives and solutions | Global |

| Danone | Strong brand recognition and research | Probiotic formulations | Global |

| ProbioFerm | Specialization in probiotic products | Probiotics for animal feed | Europe, North America |

| BioCare Copenhagen | Focus on natural ingredients | Probiotics and feed solutions | Europe |

Emerging Players & Regional Champions

- ProbioFerm (Germany): Specializes in innovative probiotic solutions for livestock, recently secured a contract with a major poultry producer in Europe, challenging established vendors by offering tailored formulations that enhance gut health and feed efficiency.

- BioCare Copenhagen (Denmark): Focuses on organic probiotic additives for aquaculture, recently implemented a pilot program with a leading fish farm, complementing established players by providing sustainable alternatives that meet increasing regulatory demands.

- Probiotics International (UK): Offers a range of probiotic products for ruminants, recently expanded its distribution network in Asia, positioning itself as a challenger to traditional feed additive companies by emphasizing research-backed efficacy and animal welfare.

- NutraBlend (USA): Develops custom probiotic blends for swine and poultry, recently partnered with a large feed mill in the Midwest, enhancing its competitive edge against established vendors through innovative formulations that improve growth rates and reduce antibiotic use.

Regional Trends: In 2024, there is a notable increase in the adoption of probiotics in animal feed across Europe and North America, driven by stricter regulations on antibiotic use and a growing consumer preference for sustainably raised livestock. Additionally, Asia-Pacific is emerging as a significant market due to rising aquaculture practices and the demand for high-quality feed. Technology specialization is shifting towards customized probiotic solutions that cater to specific animal needs, with a focus on enhancing gut health and overall productivity.

Collaborations & M&A Movements

- BASF and Chr. Hansen entered into a partnership to develop innovative probiotic solutions aimed at improving livestock health and productivity, enhancing their competitive positioning in the growing probiotics market.

- Cargill acquired a minority stake in a leading probiotic startup to expand its portfolio in animal nutrition, aiming to leverage the startup's technology to strengthen its market share in the animal feed sector.

- Eligo Bioscience and Evonik Industries announced a collaboration to create tailored probiotic solutions for poultry, focusing on sustainability and animal welfare, which positions them favorably amidst increasing regulatory scrutiny on animal feed ingredients.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Product Innovation | Alltech, Chr. Hansen, Bifodan | Alltech has developed a range of proprietary probiotic blends tailored for specific animal species, enhancing gut health and feed efficiency. Chr. Hansen's focus on research-backed strains has led to successful case studies in poultry and swine, demonstrating improved growth rates. |

| Regulatory Compliance | Evonik, Lallemand Animal Nutrition | Evonik has established a robust compliance framework that aligns with global feed safety standards, ensuring their probiotics meet stringent regulations. Lallemand's proactive approach in engaging with regulatory bodies has facilitated smoother market entry for their innovative products. |

| Sustainability Practices | Novozymes, Kemin Industries | Novozymes emphasizes sustainable sourcing of raw materials for their probiotics, reducing environmental impact. Kemin has implemented a circular economy model in their production processes, showcasing their commitment to sustainability in animal nutrition. |

| Technical Support and Education | DSM Nutritional Products, Phibro Animal Health | DSM provides extensive training programs for farmers and feed manufacturers on the benefits and application of probiotics, enhancing adoption rates. Phibro offers tailored technical support, helping clients optimize probiotic use in their feed formulations. |

| Market Reach and Distribution | Cargill, Nutreco | Cargill's extensive global distribution network allows for rapid deployment of their probiotic products across various regions. Nutreco leverages its strong relationships with feed manufacturers to ensure widespread availability of their innovative probiotic solutions. |

Conclusion: Navigating the Probiotics Market Landscape

The Probiotics in Animal Feed Market is characterized by intense competitive dynamics and significant fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a growing demand for sustainable and high-quality feed solutions, prompting vendors to innovate and adapt their offerings. Legacy players are leveraging established distribution networks and brand loyalty, while emerging companies are focusing on agility and cutting-edge technologies. Key capabilities such as AI-driven analytics, automation in production processes, and a commitment to sustainability will be critical in determining market leadership. As decision-makers navigate this evolving landscape, strategic investments in these areas will be essential for maintaining a competitive edge and meeting the increasing demands of the market.

Leave a Comment