Rising Demand for Animal Protein

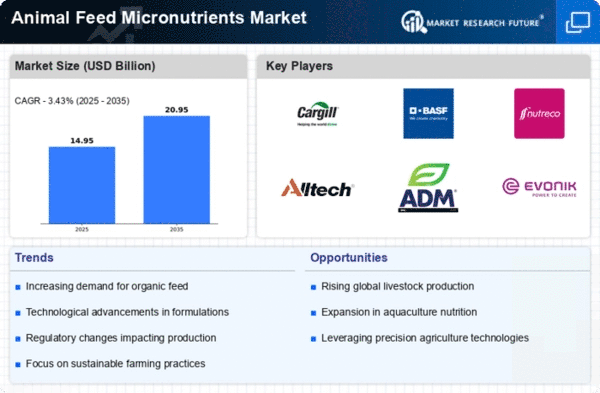

The Global Animal Feed Micronutrients Market Industry experiences a notable surge in demand for animal protein, driven by increasing global population and changing dietary preferences. As consumers shift towards protein-rich diets, livestock production intensifies, necessitating enhanced feed formulations. This trend is reflected in the market's projected growth, with an estimated value of 14.4 USD Billion in 2024, expected to reach 20.9 USD Billion by 2035. The incorporation of micronutrients in animal feed is crucial for optimizing livestock health and productivity, thereby supporting the burgeoning demand for high-quality animal protein.

Regulatory Support for Nutritional Standards

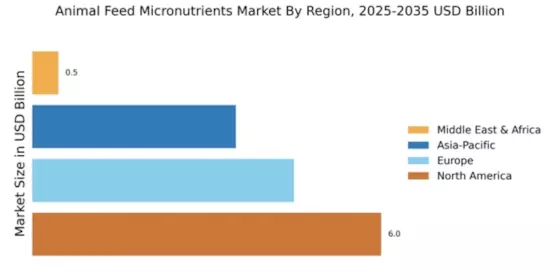

Regulatory frameworks across various regions are increasingly emphasizing the nutritional standards for animal feed, which significantly impacts the Global Animal Feed Micronutrients Market Industry. Governments are implementing guidelines to ensure that livestock receives adequate micronutrients for optimal health and productivity. This regulatory support not only promotes the use of micronutrient-rich feed but also encourages manufacturers to innovate and improve their product offerings. Consequently, the market is likely to witness sustained growth, as compliance with these regulations becomes essential for producers aiming to maintain competitive advantages in the livestock sector.

Technological Advancements in Feed Production

Technological innovations in feed production processes are transforming the Global Animal Feed Micronutrients Market Industry. Advances in formulation techniques, such as precision nutrition and the use of feed additives, enable manufacturers to create more effective and efficient feed products. These innovations allow for the precise delivery of essential micronutrients tailored to the specific needs of different livestock species. As a result, producers can achieve better feed conversion rates and overall animal health. This trend is expected to contribute to the market's growth trajectory, as producers increasingly adopt these technologies to enhance productivity and profitability.

Nutritional Awareness Among Livestock Producers

There is a growing awareness among livestock producers regarding the importance of micronutrients in animal health and productivity. The Global Animal Feed Micronutrients Market Industry benefits from this trend, as producers increasingly recognize that micronutrient deficiencies can lead to reduced growth rates and lower feed efficiency. This heightened understanding encourages the adoption of specialized feed formulations that include essential vitamins and minerals. As a result, the market is poised for steady growth, with a projected CAGR of 3.43% from 2025 to 2035, reflecting the commitment of producers to enhance livestock performance through improved nutrition.

Sustainability Initiatives in Animal Agriculture

Sustainability initiatives within the animal agriculture sector are driving changes in the Global Animal Feed Micronutrients Market Industry. As consumers and regulatory bodies push for more environmentally friendly practices, livestock producers are seeking ways to reduce their ecological footprint. This includes optimizing feed formulations to improve nutrient utilization and minimize waste. The emphasis on sustainability is likely to lead to increased demand for micronutrient-enriched feeds that support animal health while also promoting environmental stewardship. This shift may further enhance the market's growth potential as producers align their practices with sustainability goals.