Infrastructure Development and Urbanization

Infrastructure development and urbanization significantly influence the Power Rental Market. As urban areas expand, the demand for construction projects increases, necessitating reliable power sources. Rental power solutions are often preferred due to their ability to provide immediate energy without the long lead times associated with permanent installations. In many regions, government initiatives aimed at enhancing infrastructure are underway, further propelling the need for temporary power solutions. The Power Rental Market is poised to benefit from these developments, as it offers scalable and efficient energy solutions tailored to the specific requirements of construction and urban projects. This trend is expected to contribute to a steady increase in market size, as more projects emerge globally.

Expansion of Events and Entertainment Sector

The expansion of the events and entertainment sector significantly impacts the Power Rental Market. With an increasing number of festivals, concerts, and corporate events, the demand for temporary power solutions is on the rise. Event organizers often require substantial power for lighting, sound systems, and other equipment, making rental solutions an attractive option. The flexibility and scalability of rental power allow event planners to tailor their energy needs according to the size and scope of their events. In 2025, the events sector is expected to contribute a considerable share to the overall power rental market, reflecting the industry's dynamic nature. The Power Rental Market thus plays a vital role in supporting the vibrant events landscape, ensuring that energy demands are met efficiently and effectively.

Technological Innovations in Power Generation

Technological innovations are reshaping the Power Rental Market, enhancing efficiency and reliability in power generation. Advances in generator technology, such as the development of more efficient engines and smart monitoring systems, are enabling rental companies to offer superior products. These innovations not only improve fuel efficiency but also reduce emissions, aligning with the growing emphasis on sustainability. Furthermore, the integration of IoT and data analytics allows for real-time monitoring and predictive maintenance, ensuring optimal performance of rental equipment. As these technologies continue to evolve, they are likely to attract more customers seeking reliable and efficient power solutions. The Power Rental Market is thus positioned to leverage these advancements, driving growth and enhancing service offerings.

Increasing Demand for Temporary Power Solutions

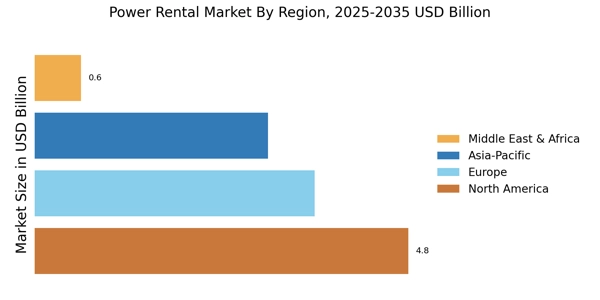

The Power Rental Market experiences a notable surge in demand for temporary power solutions across various sectors. Industries such as construction, events, and emergency services increasingly rely on rental power to meet their energy needs. This trend is driven by the need for flexibility and cost-effectiveness, as companies prefer renting over purchasing equipment. In 2025, the market is projected to reach a valuation of approximately USD 25 billion, reflecting a compound annual growth rate of around 6.5%. This growth indicates a robust shift towards rental solutions, as businesses seek to optimize operational efficiency while minimizing capital expenditure. The Power Rental Market thus plays a crucial role in providing reliable energy solutions during peak demand periods or unforeseen outages.

Growing Focus on Sustainability and Renewable Energy

The Power Rental Market is increasingly aligned with sustainability and renewable energy initiatives. As organizations strive to reduce their carbon footprint, there is a growing preference for rental solutions that incorporate cleaner energy sources. Many rental companies are now offering hybrid and renewable energy options, such as solar and wind, to meet the evolving demands of environmentally conscious clients. This shift not only supports sustainability goals but also enhances the market's appeal to a broader range of customers. In 2025, it is anticipated that the share of renewable energy in the rental market will rise significantly, reflecting a broader trend towards sustainable practices across industries. The Power Rental Market thus stands at the forefront of this transition, providing innovative solutions that align with global sustainability objectives.