Growth in Events and Festivals

The Rental Power Generation Market benefits from the increasing number of events and festivals that require temporary power solutions. Concerts, sporting events, and large gatherings often necessitate substantial power for lighting, sound systems, and other equipment. As the events industry continues to flourish, the demand for rental generators is likely to rise. In recent years, the market has seen a notable increase in rental power solutions for outdoor events, with estimates suggesting a growth rate of around 5% annually. This trend underscores the importance of reliable power sources in ensuring the success of large-scale events, thereby driving the Rental Power Generation Market forward.

Rising Infrastructure Development

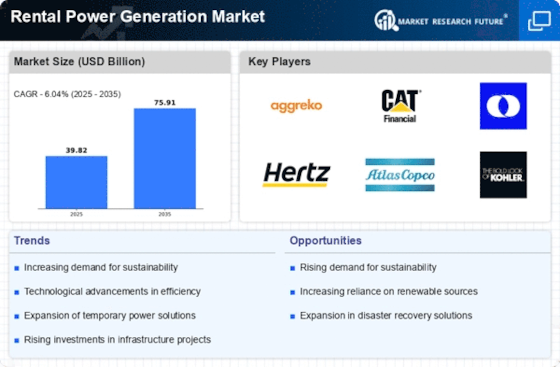

The Rental Power Generation Market experiences a notable surge due to the increasing infrastructure development across various sectors. Governments and private entities are investing heavily in construction projects, necessitating temporary power solutions to support operations. For instance, the construction of roads, bridges, and commercial buildings often requires reliable power sources that can be deployed quickly. This trend is expected to continue, with the market projected to grow at a compound annual growth rate of approximately 6% over the next few years. The need for uninterrupted power during construction phases drives demand for rental power solutions, making it a critical driver in the Rental Power Generation Market.

Increased Adoption of Hybrid Power Systems

The Rental Power Generation Market is increasingly shaped by the adoption of hybrid power systems that combine traditional generators with renewable energy sources. This trend reflects a growing awareness of sustainability and the need for cleaner energy solutions. Hybrid systems can provide reliable power while reducing emissions, making them attractive for various applications, including construction and events. The market for hybrid rental power solutions is expected to grow as businesses seek to enhance their environmental credentials. This shift towards hybridization indicates a transformative phase for the Rental Power Generation Market, aligning with broader trends in energy consumption and environmental responsibility.

Emergency Preparedness and Disaster Recovery

The Rental Power Generation Market is significantly influenced by the increasing focus on emergency preparedness and disaster recovery. Natural disasters, such as hurricanes and floods, often disrupt power supply, leading to a heightened demand for rental power solutions. Organizations and governments are recognizing the importance of having contingency plans in place, which includes access to temporary power sources. The market for rental generators is expected to expand as businesses and municipalities invest in backup power systems to ensure operational continuity during emergencies. This trend indicates a growing awareness of the need for resilience in power supply, positioning the Rental Power Generation Market as a vital component of disaster management strategies.

Industrial Growth and Manufacturing Expansion

The Rental Power Generation Market is propelled by the ongoing industrial growth and expansion of manufacturing facilities. As industries scale up operations, the need for additional power sources becomes apparent, particularly in regions where the grid may be unreliable. Temporary power solutions are often employed to meet peak demands or during maintenance periods. The manufacturing sector, in particular, is projected to witness a growth rate of approximately 4% in the coming years, further fueling the demand for rental power solutions. This trend highlights the critical role of the Rental Power Generation Market in supporting industrial activities and ensuring operational efficiency.