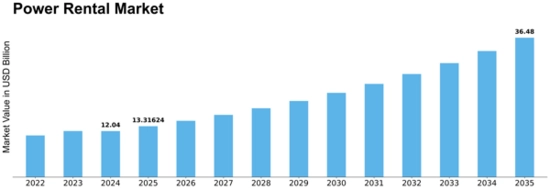

Power Rental Size

Power Rental Market Growth Projections and Opportunities

Power rental is the practice of leasing generator sets for power generation, utilizing fuels such as gas, diesel, or others. Customers opting for generator rentals typically choose diesel or gas as their fuel source. Companies offering power rental equipment do not supply fuel but provide the necessary setup to meet power requirements.

Several factors drive the power rental market, including growth in the construction sector, increased power consumption, and power supply shortages. However, the market faces constraints, such as stringent government regulations and emission standards for diesel engines.

The global power rental market is anticipated to witness a Compound Annual Growth Rate (CAGR) of 9.06% during the forecast period. In 2016, North America dominated the market with a 31.6% share, followed by Asia-Pacific and Europe, holding shares of 22.3% and 16.8%, respectively.

The power rental market is segmented based on fuel type, application, end-user, and region. Diesel fuel claimed the largest market share at 72.1% in 2016, with a market value of USD 8,610.8 million, and is expected to exhibit the highest CAGR of 9.69% during the forecast period. In terms of application, Base Load secured the largest market share at 46.7% in 2016, with a market value of USD 5,577.3 million, and is projected to grow at a CAGR of 9.28% during the forecast period. These segments provide insights into the diverse aspects influencing the power rental market.

The prominence of North America in the power rental market is evident from its leading market share in 2016. Asia-Pacific and Europe follow suit, reflecting the global distribution of the power rental market. The market dynamics vary across regions due to factors such as economic development, energy demand, and infrastructure projects.

Diesel emerges as the dominant fuel type in the power rental market, holding the majority market share in 2016 and poised for significant growth with the highest projected CAGR during the forecast period. This highlights the preference for diesel-powered generators in various applications, driven by factors like availability, reliability, and efficiency.

Within applications, Base Load, occupying the largest market share in 2016, is anticipated to continue its growth trajectory with a notable CAGR during the forecast period. This underscores the significance of base load power generation requirements and the consistent demand for power rental services in this category.

The power rental market's growth potential is underscored by the steady rise in demand attributed to construction activities, escalating power consumption, and the persistent challenge of power shortages. However, the market's progress is tempered by regulatory hurdles and emissions standards, particularly for diesel engines. Striking a balance between meeting power needs and adhering to environmental norms remains a crucial aspect influencing the trajectory of the power rental market.

Leave a Comment