Market Growth Projections

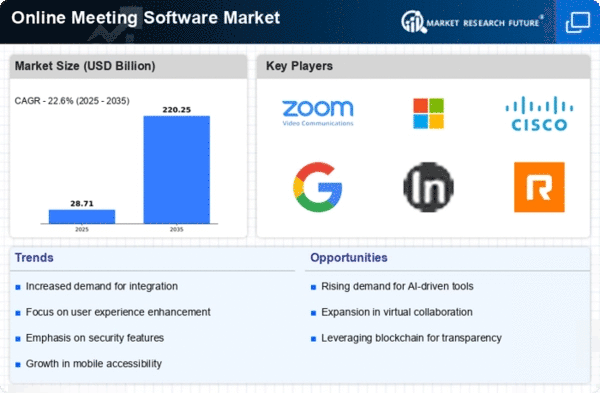

The Global Online Meeting Software Market Industry is poised for remarkable growth, with projections indicating a rise from 23.4 USD Billion in 2024 to an estimated 220.2 USD Billion by 2035. This trajectory suggests a compound annual growth rate of 22.58% from 2025 to 2035, highlighting the increasing reliance on digital communication tools across various sectors. The expansion of the market is driven by factors such as the rising adoption of remote work, technological advancements, and the globalization of businesses. As organizations continue to seek efficient and cost-effective solutions for their communication needs, the online meeting software market is likely to flourish in the coming years.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Online Meeting Software Market Industry. Innovations such as artificial intelligence, machine learning, and enhanced video conferencing capabilities are transforming how meetings are conducted. These technologies enable features like real-time language translation, automated transcription, and improved user interfaces, which enhance the overall user experience. As organizations increasingly seek sophisticated solutions to meet their communication needs, the market is expected to witness substantial growth. The integration of advanced technologies not only improves functionality but also attracts a broader user base, thereby contributing to the projected market expansion to 220.2 USD Billion by 2035.

Globalization of Businesses

The globalization of businesses significantly influences the Global Online Meeting Software Market Industry. As companies expand their operations across borders, the need for seamless communication tools becomes paramount. Online meeting software facilitates real-time collaboration among teams located in different geographical regions, thereby enhancing productivity and fostering innovation. This trend is particularly relevant in industries such as technology and finance, where timely decision-making is crucial. The increasing interconnectedness of global markets necessitates the adoption of effective online meeting solutions, contributing to the market's growth trajectory. The anticipated rise in market value to 220.2 USD Billion by 2035 reflects the importance of these tools in a globalized business environment.

Rising Adoption of Remote Work

The Global Online Meeting Software Market Industry experiences a notable surge in demand due to the increasing adoption of remote work practices. Organizations worldwide are recognizing the need for effective communication tools that facilitate collaboration among dispersed teams. In 2024, the market is projected to reach 23.4 USD Billion, reflecting a growing reliance on digital platforms for meetings and discussions. This trend is likely to continue as businesses seek to enhance productivity and maintain operational efficiency. The shift towards remote work is not merely a temporary adjustment but appears to be a long-term strategy for many companies, thereby driving the growth of the online meeting software sector.

Increased Focus on Cost Efficiency

Cost efficiency remains a driving force behind the growth of the Global Online Meeting Software Market Industry. Organizations are increasingly recognizing the financial benefits of utilizing online meeting solutions compared to traditional in-person meetings. By reducing travel expenses and minimizing time away from work, companies can allocate resources more effectively. This trend is particularly pronounced in sectors where budget constraints are prevalent. As a result, the demand for cost-effective online meeting solutions is likely to rise, further propelling the market forward. The anticipated compound annual growth rate of 22.58% from 2025 to 2035 underscores the potential for significant market expansion driven by cost-conscious organizations.

Growing Demand for Enhanced Security Features

The growing demand for enhanced security features is a critical driver of the Global Online Meeting Software Market Industry. As organizations increasingly rely on digital communication platforms, concerns regarding data privacy and security have escalated. Users seek solutions that offer robust encryption, secure access controls, and compliance with regulatory standards. This trend is particularly pronounced in sectors such as healthcare and finance, where sensitive information is frequently exchanged. Software providers are responding by integrating advanced security measures into their offerings, thereby attracting organizations that prioritize data protection. The emphasis on security is likely to bolster market growth, as businesses seek reliable solutions to safeguard their communications.