Rising Demand for Remote Work Solutions

The online meeting-software market in India experiences a notable surge in demand as organizations increasingly adopt remote work policies. This shift is driven by the need for effective communication tools that facilitate collaboration among distributed teams. According to recent data, approximately 70% of Indian companies have implemented remote work strategies, leading to a heightened reliance on online meeting software. This trend is expected to continue, with projections indicating a growth rate of around 15% annually in the sector. As businesses seek to enhance productivity and maintain operational efficiency, the online meeting-software market becomes a critical component of their digital transformation strategies.

Growing Demand for Cost-Effective Solutions

The online meeting-software market in India is experiencing a shift towards cost-effective solutions as businesses seek to optimize their operational expenses. Many organizations are transitioning from traditional meeting formats to online platforms, which often offer lower costs associated with travel and venue arrangements. Recent surveys indicate that around 65% of companies are prioritizing budget-friendly meeting solutions, leading to increased adoption of online software. This trend is expected to drive market growth, as more businesses recognize the financial benefits of utilizing online meeting tools. The online meeting-software market is thus becoming an essential resource for organizations aiming to enhance efficiency while managing costs.

Increased Focus on Training and Development

In India, the online meeting-software market is witnessing a growing emphasis on training and development initiatives. Companies are increasingly utilizing online meeting platforms to conduct training sessions, workshops, and seminars, thereby enhancing employee skills and knowledge. This trend is supported by the fact that around 60% of organizations have reported improved training outcomes through virtual platforms. The market is expected to expand as businesses recognize the cost-effectiveness and accessibility of online training solutions. Consequently, the online meeting-software market becomes integral to fostering a culture of continuous learning and development within organizations.

Technological Advancements in Communication Tools

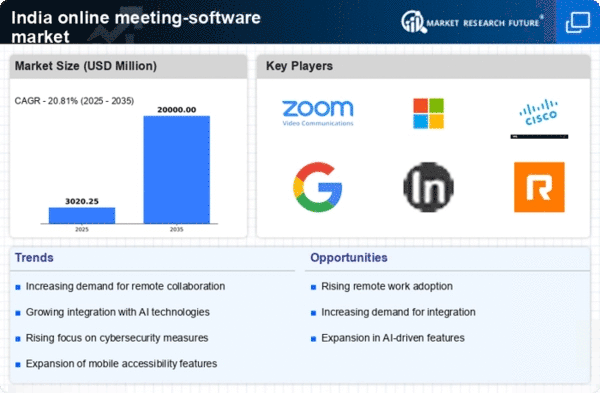

The online meeting-software market in India is significantly influenced by rapid technological advancements. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into meeting platforms, enhancing user experience and functionality. Features like real-time language translation and automated meeting summaries are becoming commonplace, appealing to a diverse user base. Furthermore, the market is projected to grow by 20% over the next five years, driven by these technological enhancements. As organizations seek to leverage these advancements, the online meeting-software market is poised for substantial growth, reflecting the evolving needs of modern businesses.

Expansion of Internet Connectivity and Digital Infrastructure

The online meeting-software market in India is benefiting from the rapid expansion of internet connectivity and digital infrastructure. With the government’s initiatives to improve broadband access, more individuals and businesses are gaining reliable internet access. As of November 2025, approximately 80% of urban areas and 50% of rural regions have access to high-speed internet, facilitating the adoption of online meeting solutions. This increased connectivity is likely to drive market growth, as more users can participate in virtual meetings without connectivity issues. The online meeting-software market is thus positioned to thrive in this evolving digital landscape.