Rising Energy Demand

The Oil & Gas Engineering Services Market is driven by an increasing global energy demand, particularly in emerging economies. As populations grow and industrial activities expand, the need for reliable energy sources intensifies. Reports indicate that global energy consumption is projected to rise by approximately 25% by 2040, necessitating significant investments in oil and gas infrastructure. This demand compels engineering service providers to innovate and expand their offerings, ensuring that they can meet the evolving needs of the market. Consequently, this driver presents opportunities for growth and development within the sector.

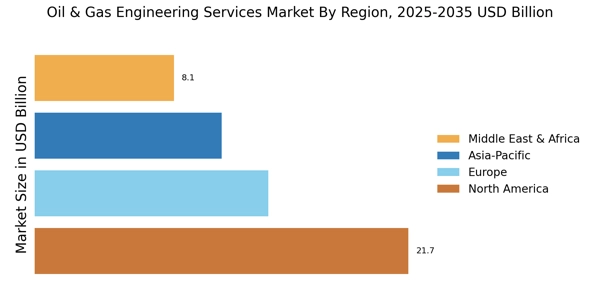

Geopolitical Tensions

The Oil & Gas Engineering Services Market is significantly affected by geopolitical tensions that can disrupt supply chains and influence market stability. Conflicts in oil-rich regions often lead to fluctuations in oil prices, which in turn impacts investment decisions within the industry. For instance, recent tensions in the Middle East have resulted in increased volatility in oil prices, prompting companies to seek engineering services that can enhance operational resilience. This environment creates opportunities for engineering firms to provide solutions that mitigate risks associated with geopolitical uncertainties, thereby ensuring continuity in operations.

Regulatory Compliance

The Oil & Gas Engineering Services Market is heavily influenced by regulatory compliance requirements that govern environmental and safety standards. Governments worldwide are implementing stricter regulations to mitigate the environmental impact of oil and gas operations. This trend necessitates engineering services that can assist companies in adhering to these regulations, thereby avoiding costly penalties. For example, the implementation of the International Maritime Organization's regulations on emissions is prompting companies to invest in cleaner technologies. As a result, engineering firms that specialize in compliance solutions are likely to see increased demand for their services.

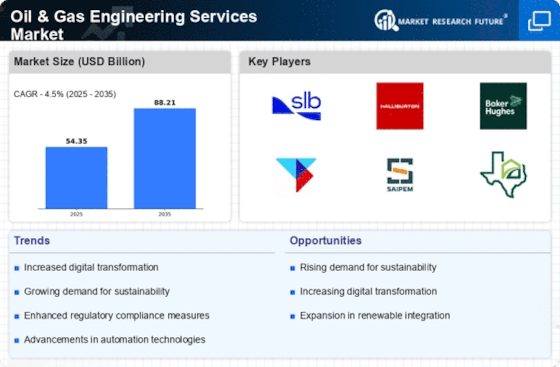

Technological Advancements

The Oil & Gas Engineering Services Market is experiencing a surge in technological advancements that enhance operational efficiency and safety. Innovations such as automation, artificial intelligence, and advanced data analytics are transforming traditional practices. For instance, the integration of AI in predictive maintenance can reduce downtime and operational costs significantly. According to recent data, companies that adopt these technologies may see productivity increases of up to 30%. This trend not only streamlines processes but also aligns with the industry's push towards more sustainable practices, as technology can optimize resource use and minimize waste.

Investment in Renewable Energy

The Oil & Gas Engineering Services Market is witnessing a shift as companies diversify their portfolios to include renewable energy projects. This transition is driven by the need to adapt to changing market dynamics and consumer preferences for cleaner energy sources. Investments in renewable technologies, such as wind and solar, are becoming more prevalent, with projections indicating that the renewable energy sector could attract over 10 trillion dollars in investments by 2030. Engineering service providers that can offer expertise in both traditional oil and gas and renewable energy projects are well-positioned to capitalize on this trend.