Geopolitical Factors

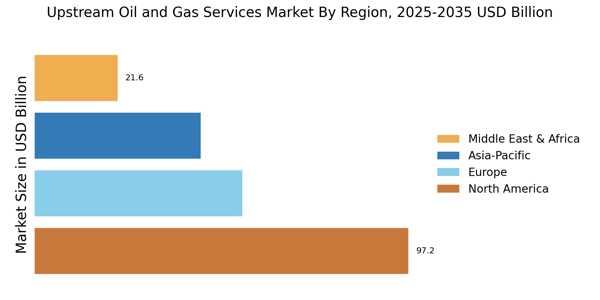

Geopolitical factors significantly influence the Upstream Oil and Gas Services Market, as political stability and international relations can impact oil and gas production and distribution. Regions rich in resources often face geopolitical tensions, which can disrupt supply chains and affect market dynamics. For instance, conflicts in oil-rich regions may lead to fluctuations in oil prices, prompting companies to reassess their operational strategies. Additionally, trade agreements and sanctions can alter the landscape for upstream services, creating both challenges and opportunities. Companies that navigate these geopolitical complexities effectively may find themselves better positioned to capitalize on emerging markets and secure their supply chains, thereby driving growth in the upstream oil and gas services sector.

Rising Energy Demand

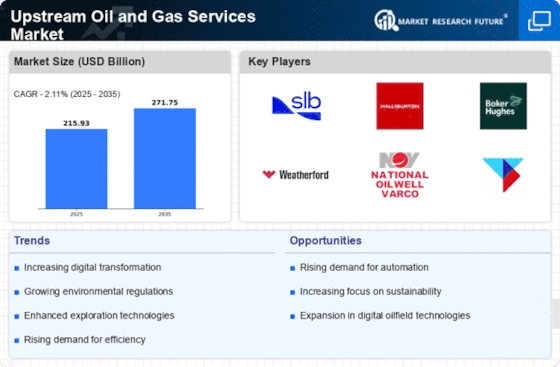

The Upstream Oil and Gas Services Market is currently experiencing a surge in energy demand, driven by increasing industrial activities and population growth. As economies expand, the need for energy resources intensifies, prompting exploration and production activities. According to recent data, global energy consumption is projected to rise by approximately 30% by 2040, necessitating enhanced upstream services to meet this demand. This trend compels companies to invest in advanced technologies and efficient extraction methods, thereby bolstering the upstream oil and gas services sector. Furthermore, the transition towards cleaner energy sources may also influence the types of services required, as companies seek to balance traditional oil and gas production with renewable energy initiatives.

Regulatory Frameworks

The regulatory frameworks governing the Upstream Oil and Gas Services Market are becoming increasingly stringent, influencing operational practices and investment strategies. Governments are implementing policies aimed at environmental protection and sustainable resource management, which necessitate compliance from industry players. For example, regulations concerning emissions and waste management are compelling companies to adopt cleaner technologies and practices. This shift not only impacts operational costs but also opens avenues for service providers specializing in compliance and environmental management. As the regulatory landscape evolves, companies that proactively adapt to these changes may gain a competitive edge, thereby driving growth within the upstream services sector.

Technological Advancements

Technological advancements play a pivotal role in shaping the Upstream Oil and Gas Services Market. Innovations such as digitalization, automation, and advanced drilling techniques are revolutionizing exploration and production processes. For instance, the adoption of artificial intelligence and machine learning is enhancing predictive maintenance and operational efficiency. Data from industry reports indicates that the implementation of these technologies can reduce operational costs by up to 20%. Moreover, the integration of Internet of Things (IoT) devices allows for real-time monitoring of equipment, leading to improved safety and reduced downtime. As these technologies continue to evolve, they are likely to drive further investment in upstream services, fostering a more competitive landscape.

Investment in Exploration Activities

Investment in exploration activities is a critical driver for the Upstream Oil and Gas Services Market. As existing reserves deplete, companies are compelled to seek new sources of oil and gas, leading to increased exploration efforts. Recent statistics indicate that exploration budgets have seen a resurgence, with a projected increase of 10% in 2025 compared to previous years. This uptick in investment not only stimulates demand for upstream services but also encourages collaboration between companies and service providers. Enhanced exploration activities necessitate advanced geological and geophysical services, thereby creating opportunities for specialized firms within the upstream sector. The focus on discovering untapped reserves is likely to sustain growth in the industry.