Rising Energy Demand

The oil gas-engineering-services market is experiencing a notable surge in demand driven by increasing energy requirements across various sectors in the US. As the economy expands, the need for reliable energy sources intensifies, prompting investments in oil and gas exploration and production. According to the US Energy Information Administration, energy consumption is projected to rise by approximately 10% by 2030. This growth necessitates enhanced engineering services to optimize extraction processes and improve operational efficiency. Consequently, companies in the oil gas-engineering-services market are likely to benefit from this upward trend, as they provide essential support in meeting the escalating energy demands.

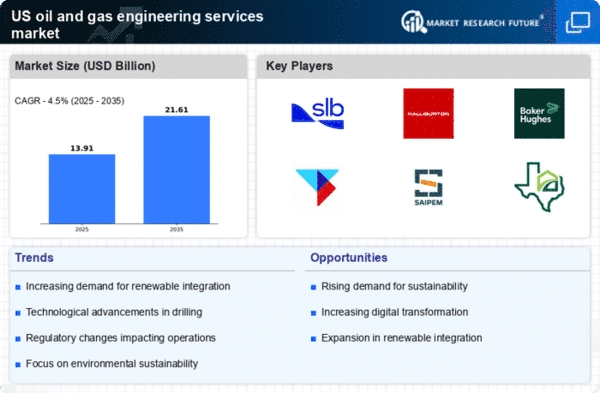

Focus on Environmental Sustainability

The oil gas-engineering-services market is increasingly influenced by a growing emphasis on environmental sustainability. As public awareness of climate change and environmental issues rises, companies are under pressure to adopt greener practices. This shift is prompting investments in technologies that reduce emissions and enhance energy efficiency. The US government has set ambitious targets for reducing greenhouse gas emissions, which necessitates the involvement of engineering services to develop and implement sustainable solutions. Consequently, firms in the oil gas-engineering-services market are likely to experience heightened demand for their expertise in creating environmentally friendly practices, thereby aligning with broader sustainability goals.

Investment in Infrastructure Development

The oil gas-engineering-services market is poised for growth due to substantial investments in infrastructure development across the US. The government and private sector are channeling funds into upgrading pipelines, refineries, and processing facilities to enhance efficiency and safety. The American Society of Civil Engineers estimates that the US requires an investment of over $4 trillion in infrastructure by 2025. This influx of capital is likely to create opportunities for engineering service providers, as they play a pivotal role in designing and implementing these critical projects. Consequently, the demand for specialized services in the oil gas-engineering-services market is expected to rise, fostering innovation and technological advancements.

Regulatory Compliance and Safety Standards

The oil gas-engineering-services market is significantly influenced by stringent regulatory frameworks and safety standards imposed by government agencies in the US. Compliance with these regulations is crucial for companies operating in the sector, as non-compliance can lead to substantial fines and operational disruptions. The Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) enforce regulations that require engineering services to ensure safe and environmentally responsible operations. As a result, firms specializing in oil gas-engineering-services are increasingly sought after to navigate these complex regulatory landscapes, thereby driving market growth and enhancing safety protocols within the industry.

Technological Integration and Digitalization

The oil gas-engineering-services market is increasingly shaped by the integration of advanced technologies and digitalization. Companies are adopting innovative solutions such as artificial intelligence, big data analytics, and automation to enhance operational efficiency and reduce costs. The implementation of these technologies allows for real-time monitoring and predictive maintenance, which can significantly minimize downtime and improve productivity. As the industry evolves, engineering service providers are likely to be at the forefront of this technological transformation, offering expertise in deploying these advanced systems. This trend not only boosts competitiveness but also positions the oil gas-engineering-services market for sustainable growth in the coming years.