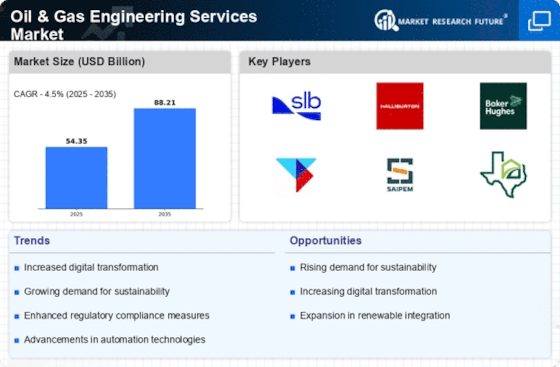

Top Industry Leaders in the Oil & Gas Engineering Services Market

*Disclaimer: List of key companies in no particular order

Competitive Landscape of the Oil & Gas Engineering Services Companies

The oil and gas engineering services market plays a crucial role in facilitating the exploration, development, and production of oil and gas resources. It encompasses a wide range of services, including feasibility studies, front-end engineering design (FEED), detailed engineering, procurement, construction management, commissioning, and asset integrity management. This market is expected to experience significant growth in the coming years, driven by factors such as rising energy demand, increasing investments in unconventional oil and gas resources, and the need for enhanced efficiency and safety in operations.

Key Players and Market Share Analysis

The competitive landscape of the oil and gas engineering services market is moderately fragmented, featuring a mix of established global players and niche regional companies. Some of the key players in this market include:

- Stress Engineering Services Inc.

- Toyo Engineering Corporation

- Element Materials Technology

- L&T Technology Services Limited

- Arseal Technologies

- Citec Group Oy Ab

- WSP Global Inc.

- Wood PLC

- Tetra Tech, Inc.

- Mannvit Consulting Engineers

- QuEST Global Services Pte. Ltd.

- M&H

- Hatch Ltd.

- Lloyd's Register Group Services Limited, and others.

Market Share Analysis

In the oil and gas engineering services market is complex due to the diverse range of services offered and the fragmented nature of the market. However, some key factors influencing market share include:

-

Company size and global reach: Larger companies with a wider geographical presence tend to have a larger market share. -

Service portfolio: Companies offering a comprehensive range of services across the upstream, midstream, and downstream segments are typically more competitive. -

Technical expertise and experience: Companies with a proven track record of success in delivering complex projects are more likely to be awarded new contracts. -

Cost competitiveness: Offering competitive pricing and flexible commercial arrangements can be a key differentiator in securing contracts. -

Customer relationships: Building strong relationships with key oil and gas companies can help secure repeat business and long-term partnerships.

Strategies Adopted by Major Players

Major players in the oil and gas engineering services market are adopting various strategies to maintain and expand their market share. These strategies include:

-

Geographic expansion: Entering new markets and expanding into high-growth regions. -

Diversification of service portfolio: Expanding service offerings to cover new segments or niche areas. -

Strategic partnerships and acquisitions: Collaborating with other companies to enhance capabilities or gain access to new markets and technologies. -

Investment in research and development: Focusing on developing new technologies and solutions to address emerging challenges in the oil and gas industry. -

Digitalization: Implementing digital tools and technologies to improve efficiency, safety, and data analytics capabilities. -

Focus on sustainability: Integrating sustainability practices into operations and service offerings to meet evolving environmental regulations and customer requirements.

New and Emerging Companies

The oil and gas engineering services market is also witnessing the emergence of new and innovative companies. These companies are often focused on specific niche areas or technologies, such as:

-

Subsea engineering and construction: Companies specializing in the development and deployment of subsea infrastructure for offshore oil and gas production. -

Data analytics and digital solutions: Companies providing software and services to help oil and gas companies optimize their operations and decision-making through data analysis. -

Remote operations and robotics: Companies developing technologies for automating and remotely controlling various oil and gas operations. -

Renewable energy integration: Companies offering engineering services for integrating renewable energy sources into oil and gas operations.

These emerging companies are bringing fresh perspectives and innovative solutions to the market, potentially challenging the established players and shaping the future of the oil and gas engineering services landscape.

Company Updates:

Stress Engineering Services Inc. (SES):

- 2023-12-08: SES announces the acquisition of a leading provider of fatigue analysis services for the oil & gas industry. This acquisition expands SES's service portfolio and strengthens its presence in the market.

- 2023-11-30: SES secures a multi-year contract with a major oil & gas company to provide engineering services for a new offshore pipeline project.

Toyo Engineering Corporation (TOYO):

- 2023-12-07: TOYO signs a memorandum of understanding with a Saudi Arabian oil & gas company to collaborate on developing innovative technologies for carbon capture, utilization, and storage (CCUS).

- 2023-11-29: TOYO announces the completion of a large-scale LNG plant project in Qatar, showcasing its expertise in executing complex engineering projects.

Element Materials Technology (EMT):

- 2023-12-06: EMT launches a new service offering for the oil & gas industry focused on providing advanced materials testing and analysis.

- 2023-11-28: EMT partners with a major university to establish a joint research center for developing new materials and technologies for the oil & gas industry.

L&T Technology Services Limited (LTTS):

- 2023-12-05: LTTS announces its collaboration with a leading energy company to develop digital twins of its oil & gas assets for improved operational efficiency and predictive maintenance.

- 2023-11-27: LTTS wins a multi-million dollar contract from a global oil & gas company to provide digital transformation services.