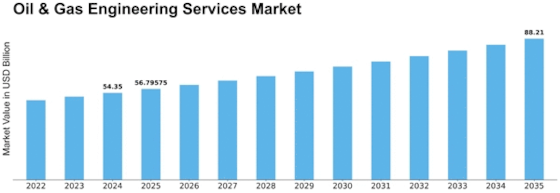

Oil Gas Engineering Services Size

Oil & Gas Engineering Services Market Growth Projections and Opportunities

The Oil and gas Engineering Services marketplace is encouraged by using a myriad of factors that shape its dynamics and overall performance. One of the primary marketplace factors is the global demand for strength. As the arena continues to rely heavily on fossil fuels, particularly oil and fuel, the need for efficient engineering offerings to extract, process, and ship those assets remains critical. Regulatory guidelines additionally exert a vast impact on the Oil and gas Engineering Services market. Governments worldwide enact and amend rules that govern the exploration, extraction, and transportation of oil and fuel. Stringent environmental policies, protection requirements, and emission controls can affect the design and implementation of engineering answers. Companies working in the marketplace ought to adapt to evolving regulatory landscapes to remain compliant and sustain their operations. Technological improvements constitute another crucial issue in the marketplace. Innovations in drilling technology, reservoir modeling, and statistics analytics decorate the efficiency and price effectiveness of oil and gasoline operations. Companies imparting modern engineering services gain a competitive edge inside the marketplace as customers seek understanding in adopting superior technology to optimize their tactics and enhance their usual productivity. The international geopolitical panorama notably affects the Oil and gas Engineering Services market. Political instability in key oil-generating areas, global conflicts, and diplomatic tensions can disrupt the supply chain and impact the overall market dynamics. Companies working in the zone ought to navigate those geopolitical uncertainties and adapt their strategies to mitigate dangers and ensure business continuity. Market opposition and consolidation also shape the panorama of Oil and gas Engineering Services. As organizations are looking to expand their market percentage and abilities, mergers and acquisitions grow to be prevalent. Larger entities with varied service offerings and a global presence are better placed to face up to marketplace fluctuations and offer complete solutions to customers. However, intense opposition can also power innovation as companies attempt to differentiate themselves through technological advancements and price-powerful solutions. The transition in the direction of renewable electricity assets represents a growing factor influencing the Oil and gas Engineering Services marketplace. The growing emphasis on sustainability and the global shift closer to cleaner strength sources pose challenges and opportunities for the traditional oil and gas region. Engineering carrier providers need to adapt to the changing strength panorama by diversifying their offerings to consist of renewable electricity tasks and enforcing sustainable practices in their operations. In the end, the oil and gas Engineering Services market is intricately connected to many factors that together shape its trajectory. From international energy demand and commodity fees to regulatory guidelines, technological advancements, geopolitical events, marketplace competition, and the transition to renewable power, organizations in this sector ought to navigate a complex panorama. A successful model for these market elements requires a strategic technique, continuous innovation, and the potential to expect and respond to evolving enterprise tendencies.

Leave a Comment