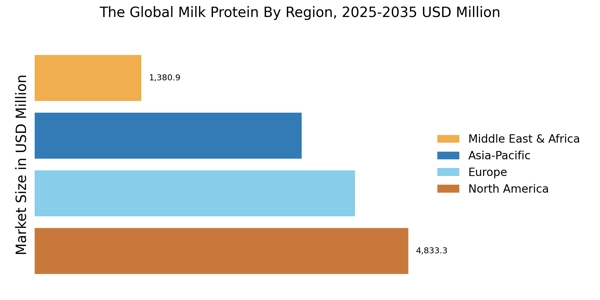

By Region, the study segments the market into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America milk protein market accounted for largest market share in 2022. The North American milk protein industry is a significant segment of the milk protein industry. North America is a major producer and consumer of milk protein products, with a highly developed dairy industry and a growing population of health-conscious consumers. The market is driven by increasing demand for high-quality protein, growing awareness of the health benefits of milk protein, and a shift towards natural and organic food products.

The region is also home to several leading milk protein manufacturers, which have invested heavily in research and development to create innovative products that meet the changing needs of consumers.

Further, the major countries studied are: The US, , Germany, France, Canada, Mexico ,UK, Italy, Spain, Japan, India, China, , Australia, South Korea, Argentina, and Brazil.

Figure 4: MILK PROTEIN MARKET SHARE BY REGION 2022 (%)

North America milk protein market accounts for the second-largest market share. The US market of milk protein segment accounted for the larger market share in 2022, with a market value of USD 3,961.8 million. North America is a major producer and consumer of milk protein products, with a highly developed dairy industry and a growing population of health-conscious consumers. The market is driven by increasing demand for high-quality protein, growing awareness of the health benefits of milk protein, and a shift towards natural and organic food products.

The region is also home to several leading milk protein manufacturers, which have invested heavily in research and development to create innovative products that meet the changing needs of consumers.

The Europe milk protein market is highly competitive, with several major players competing for market share. Some of the leading milk protein manufacturers in the region include FrieslandCampina Ingredients, Arla Foods Ingredients, Glanbia Nutritionals, and Nestle, among others. These manufacturers are using various strategies to create new and innovative products, further drive demand for the milk protein industry. For instance, in January 2022, FrieslandCampina Ingredients, a leading milk protein manufacturer in the region, announced that it has acquired Best cheese Corporation USA, a company that specializes in the production of specialty cheeses, including gouda and brie.

The acquisition is part of FrieslandCampina company’s strategy for expanding its product portfolio of value-added dairy ingredients and strengthening its position in the global dairy market. This acquisition is expected to benefit both companies and demonstrate FrieslandCampina Ingredients' commitment to growth and innovation in the Europe market of milk protein. Additionaly, The rest of europe milk protein industry accounted for the larger market share in 2022, with a market value of USD 1,017.7 million.

The Asia-Pacific milk protein market is expected to experience significant growth due to several factors, including a rising population, increasing disposable incomes, and growing health consciousness among consumers. Growing demand for protein supplements and sports nutrition products is one of the key drivers of the market for milk protein in the region. Consumers in countries such as India and China are increasingly turning to protein supplements to support their fitness and wellness goals, and this trend is expected to continue to drive growth in the milk protein industry.

The Rest of the World milk protein market in the rest of the world (ROW) region, which includes countries in Latin America, the Middle East, and Africa, is expected to grow steadily in the coming years. The market is driven by increasing awareness of the health benefits of protein consumption, rising disposable incomes, and the growing demand for functional foods and supplements.