Increasing Health Consciousness

The growing awareness of health and wellness among consumers in India is driving the milk protein market. As individuals become more health-conscious, they are increasingly seeking protein-rich foods to support their dietary needs. This trend is particularly evident among fitness enthusiasts and athletes who prioritize protein intake for muscle recovery and overall health. According to recent data, the demand for protein supplements in India has surged, with a projected growth rate of 20% annually. This shift towards healthier lifestyles is likely to bolster the milk protein market, as consumers opt for natural sources of protein, such as milk and dairy products, over synthetic alternatives.

Growing Demand for Functional Foods

The increasing consumer interest in functional foods is significantly influencing the milk protein market. Functional foods, which provide health benefits beyond basic nutrition, are gaining traction among Indian consumers. Milk protein, known for its high biological value and essential amino acids, is often incorporated into functional food products such as protein bars, fortified beverages, and snacks. Market Research Future indicates that the functional food segment is expected to grow at a CAGR of 15% in the coming years. This trend suggests that the milk protein market will benefit from the rising demand for products that promote health and wellness, as consumers seek to enhance their diets with functional ingredients.

Rising Urbanization and Lifestyle Changes

Urbanization in India is contributing to significant lifestyle changes, which in turn impacts the milk protein market. As more people migrate to urban areas, there is a noticeable shift in dietary patterns, with an increased preference for convenient and nutritious food options. The urban population is more inclined to consume ready-to-eat meals and snacks that are high in protein. This trend is reflected in the growing sales of milk protein-based products, which are perceived as convenient sources of nutrition. The urban demographic is expected to drive the milk protein market, as they seek products that align with their fast-paced lifestyles while still providing essential nutrients.

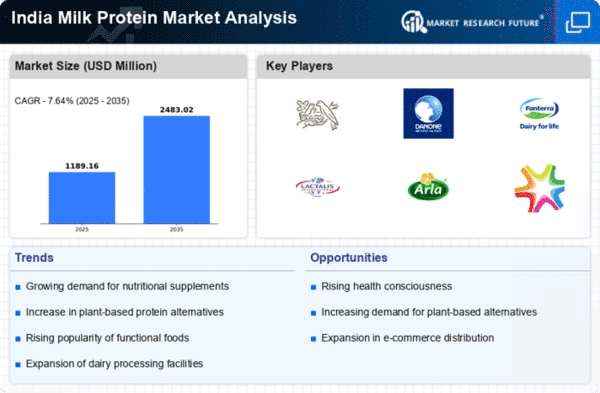

Expansion of Dairy Processing Infrastructure

The development of dairy processing infrastructure in India is a crucial driver for the milk protein market. Enhanced processing capabilities allow for the production of a wider range of milk protein products, including whey protein and casein. This expansion is supported by government initiatives aimed at improving the dairy sector, which has seen investments exceeding $1 billion in recent years. Improved processing facilities not only increase the availability of milk protein products but also enhance their quality and safety. As a result, consumers are more likely to choose these products, thereby stimulating growth in the milk protein market.

Influence of Social Media and Fitness Trends

The impact of social media and fitness trends significantly drives the milk protein market. Influencers and fitness enthusiasts frequently promote high-protein diets and products, leading to increased awareness and interest in milk protein. This trend is particularly pronounced among younger demographics, who are more likely to engage with health and fitness content online. As a result, the demand for milk protein products, such as protein shakes and bars, is likely to rise. The milk protein market may experience accelerated growth as social media continues to shape consumer preferences and drive the popularity of protein-rich diets.