Rising Defense Budgets Globally

The Global Military Surveillance Drone Market Industry is experiencing growth due to rising defense budgets across various countries. Governments are prioritizing national security and defense modernization, leading to increased funding for advanced military technologies, including surveillance drones. Countries such as India and Russia are significantly boosting their defense expenditures, which in turn fuels demand for sophisticated drone systems. This trend is expected to sustain the market's upward trajectory, as nations seek to enhance their surveillance capabilities. The financial commitment to defense modernization is likely to result in a more competitive landscape for military drone manufacturers.

Increasing Geopolitical Tensions

The Global Military Surveillance Drone Market Industry appears to be driven by escalating geopolitical tensions across various regions. Nations are increasingly investing in advanced surveillance technologies to enhance their defense capabilities. For instance, countries like the United States and China are ramping up their drone programs to monitor potential threats. This trend is likely to contribute to the market's growth, with projections indicating a market value of 1.23 USD Billion in 2024. As nations seek to maintain strategic advantages, the demand for military surveillance drones is expected to rise significantly.

Emerging Markets and Regional Developments

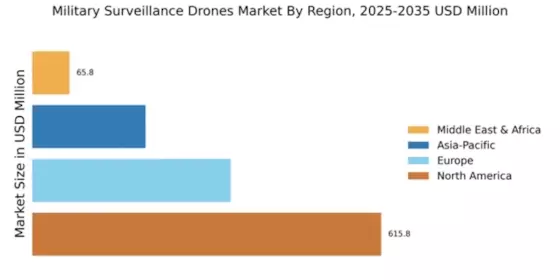

Emerging markets are increasingly becoming pivotal players in the Global Military Surveillance Drone Market Industry. Countries in regions such as Asia-Pacific and the Middle East are investing in drone technology to bolster their defense capabilities. This trend is driven by the need for enhanced surveillance and reconnaissance in response to regional security challenges. As these nations develop their military infrastructure, the demand for surveillance drones is expected to rise. The market's expansion in these regions may lead to new opportunities for manufacturers and suppliers, contributing to a more diversified global market.

Technological Advancements in Drone Capabilities

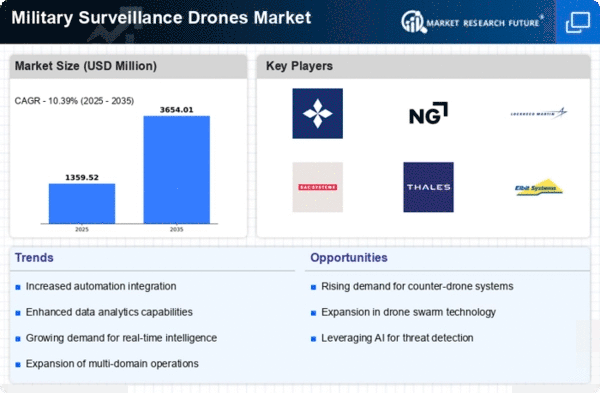

Technological innovations play a crucial role in shaping the Global Military Surveillance Drone Market Industry. Recent advancements in artificial intelligence, machine learning, and sensor technologies have enhanced the operational capabilities of drones. These developments enable drones to conduct real-time surveillance, gather intelligence, and perform reconnaissance missions with greater efficiency. As a result, military organizations are increasingly adopting these advanced systems. The market is projected to expand, with an anticipated value of 3.65 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 10.39% from 2025 to 2035.

Growing Demand for Intelligence, Surveillance, and Reconnaissance (ISR)

The demand for Intelligence, Surveillance, and Reconnaissance (ISR) capabilities is a significant driver of the Global Military Surveillance Drone Market Industry. Military forces worldwide are recognizing the importance of ISR in modern warfare, leading to increased investments in drone technology. Drones equipped with advanced imaging systems and data analytics tools provide critical situational awareness, enabling timely decision-making. This trend is likely to bolster market growth, as military budgets allocate more resources towards ISR capabilities. The anticipated growth trajectory suggests a robust market expansion, aligning with the increasing focus on enhancing national security.