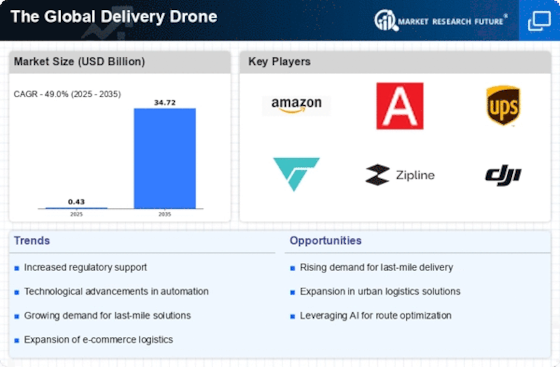

Expansion of E-commerce and Retail Sectors

The rapid expansion of e-commerce and retail sectors serves as a vital driver in The Global Delivery Drone Industry. With more consumers turning to online shopping, the volume of packages requiring delivery has surged. This trend has prompted retailers to explore innovative logistics solutions to manage increased demand efficiently. Market data reveals that e-commerce sales have consistently risen, leading to a corresponding need for faster and more reliable delivery options. Drones offer a promising solution to address these challenges, enabling retailers to streamline their operations and enhance customer satisfaction. Additionally, as competition intensifies in the retail space, businesses are likely to adopt drone technology to differentiate themselves and improve service offerings. The synergy between e-commerce growth and drone delivery capabilities appears to be a key factor driving market dynamics.

Increased Demand for Fast Delivery Services

The rise in consumer expectations for rapid delivery services is a primary driver in The Global Delivery Drone Industry. As e-commerce continues to expand, customers increasingly seek quicker fulfillment options. According to recent data, the demand for same-day and next-day delivery has surged, with a notable percentage of consumers willing to pay extra for expedited shipping. This trend compels retailers to explore innovative solutions, such as delivery drones, to meet these expectations. The convenience and speed offered by drones can significantly enhance customer satisfaction and loyalty, thereby driving market growth. Furthermore, as urbanization increases, traditional delivery methods face challenges, making drones a viable alternative for efficient logistics. The integration of drones into delivery systems appears to be a strategic response to the evolving landscape of consumer preferences.

Regulatory Support and Framework Development

The establishment of supportive regulatory frameworks is a significant driver in The Global Delivery Drone Market Industry. Governments worldwide are increasingly recognizing the potential of drones for commercial applications, leading to the development of regulations that facilitate their integration into airspace. Recent initiatives have focused on creating guidelines for safe drone operations, including air traffic management systems and certification processes. This regulatory evolution is essential for ensuring public safety while promoting innovation in the drone sector. Market data suggests that regions with clear regulatory pathways are experiencing faster adoption rates of delivery drones. As regulations become more favorable, businesses are likely to invest in drone technology, further stimulating market growth. The collaboration between industry stakeholders and regulatory bodies appears to be crucial in shaping a conducive environment for the expansion of drone delivery services.

Technological Innovations in Drone Capabilities

Technological advancements play a crucial role in shaping The Global Delivery Drone market Industry. Innovations in drone design, navigation systems, and battery life have significantly improved operational efficiency and reliability. For instance, the development of autonomous navigation technologies allows drones to operate in complex urban environments, reducing the risk of accidents and enhancing delivery accuracy. Additionally, advancements in battery technology have extended flight ranges, enabling drones to cover larger areas without the need for frequent recharging. Market data indicates that the introduction of advanced sensors and AI-driven systems is likely to enhance the capabilities of delivery drones, making them more adaptable to various delivery scenarios. As these technologies continue to evolve, they are expected to lower operational costs and increase the feasibility of drone deliveries, thereby propelling market growth.

Growing Focus on Sustainability and Environmental Impact

The increasing emphasis on sustainability is driving interest in The Global Delivery Drone market Industry. As environmental concerns gain prominence, businesses are seeking eco-friendly alternatives to traditional delivery methods. Drones, which typically have a lower carbon footprint compared to delivery trucks, present a compelling solution for reducing emissions associated with logistics. Market data indicates that companies adopting drone technology can significantly decrease their environmental impact, aligning with consumer preferences for sustainable practices. Furthermore, the potential for drones to utilize renewable energy sources, such as solar power, enhances their appeal as a green delivery option. This focus on sustainability not only meets regulatory requirements but also resonates with environmentally conscious consumers, thereby influencing purchasing decisions. As the demand for sustainable logistics solutions grows, the market for delivery drones is likely to expand.