Rising Geopolitical Tensions

the military surveillance-drones market experienced growth due to escalating geopolitical tensions.. Nations are increasingly investing in advanced surveillance technologies to monitor potential threats. For instance, the US defense budget allocates a substantial portion to unmanned aerial vehicles (UAVs), reflecting a strategic shift towards enhancing national security. In 2025, the US military is projected to spend approximately $10 billion on drone technology, indicating a robust commitment to maintaining aerial superiority. This investment is likely to drive innovation and development within the military surveillance-drones market, as countries seek to bolster their intelligence-gathering capabilities in response to global uncertainties.

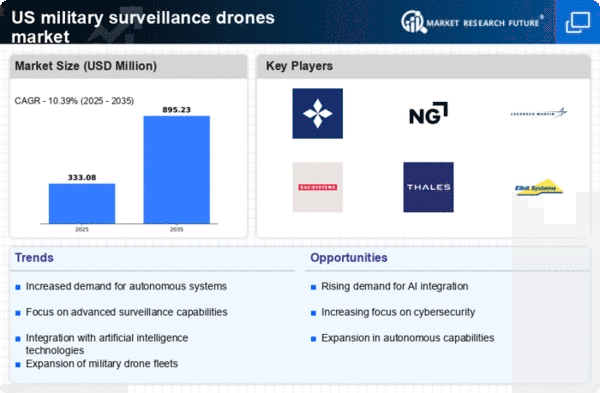

Integration of Artificial Intelligence (AI)

The integration of artificial intelligence (AI) into military surveillance-drones is transforming operational capabilities. AI enhances data processing, enabling drones to analyze vast amounts of information quickly and accurately. This technological advancement is expected to drive the military surveillance-drones market, as AI-equipped drones can autonomously identify targets and assess threats. In 2025, the market for AI in military applications is anticipated to reach $4 billion, with a significant portion attributed to surveillance-drones. The potential for AI to improve mission effectiveness and reduce human error positions it as a critical driver for the military surveillance-drones market.

Growing Focus on Counter-Terrorism Operations

The military surveillance-drones market is significantly influenced by the growing focus on counter-terrorism operations. As threats from non-state actors increase, military forces are leveraging drones for surveillance and reconnaissance missions in conflict zones. The US has deployed drones extensively in counter-terrorism efforts, with estimates indicating that drone operations have increased by 30% in recent years. This trend highlights the reliance on drones for intelligence gathering and precision strikes, thereby driving demand within the military surveillance-drones market. As counter-terrorism strategies evolve, the need for advanced surveillance capabilities is likely to persist.

Increased Investment in Defense Modernization

The military surveillance-drones market benefits from increased investment in defense modernization initiatives. Governments are prioritizing the upgrade of military capabilities, including the acquisition of advanced drone systems. In the US, the defense budget for 2025 includes a projected increase of 5% for modernization efforts, with a significant portion allocated to drone technology. This investment is expected to enhance the operational effectiveness of military forces, as modern drones offer superior surveillance capabilities compared to legacy systems. Consequently, the military surveillance-drones market is poised for growth as nations seek to modernize their defense infrastructure.

Enhanced Intelligence, Surveillance, and Reconnaissance (ISR) Capabilities

The demand for improved intelligence, surveillance, and reconnaissance (ISR) capabilities significantly influences the military surveillance-drones market. Drones equipped with advanced sensors and imaging technologies provide real-time data, which is crucial for strategic decision-making. The US military's focus on ISR operations has led to an increase in drone deployments, with estimates suggesting that over 60% of military drones are utilized for ISR purposes. This trend underscores the importance of drones in modern warfare, as they enable forces to gather actionable intelligence while minimizing risks to personnel. Consequently, the military surveillance-drones market was likely to expand as defense agencies prioritized ISR capabilities..