Urbanization and Population Growth

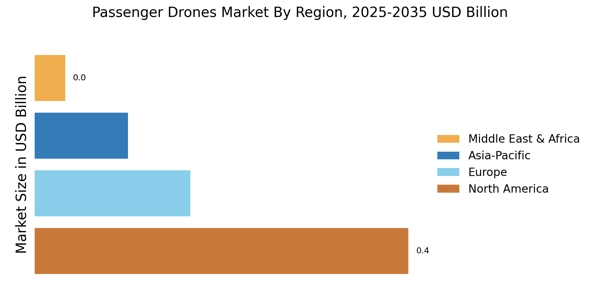

The rapid pace of urbanization and population growth appears to be a driving force in the Passenger Drones Market. As cities expand and populations increase, the demand for efficient transportation solutions intensifies. It is estimated that by 2030, nearly 60% of the world's population will reside in urban areas, leading to congested roadways and a pressing need for alternative transport methods. Passenger drones offer a potential solution to alleviate traffic congestion, providing a means to bypass traditional road networks. This shift towards aerial mobility could reshape urban landscapes, making passenger drones an attractive option for city planners and commuters alike. The Passenger Drones Market is likely to benefit from this trend, as urban centers seek innovative ways to enhance mobility and improve the quality of life for residents.

Environmental Concerns and Sustainability

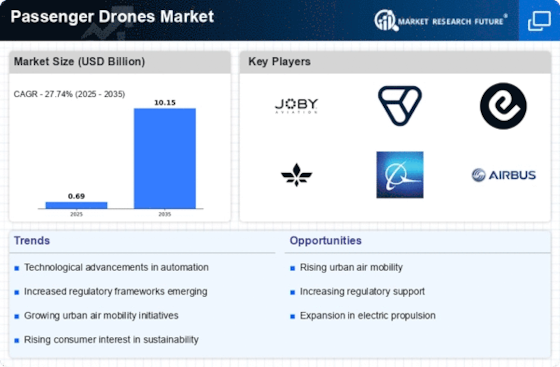

Environmental concerns and the push for sustainability are increasingly influencing the Passenger Drones Market. As awareness of climate change and air pollution grows, there is a heightened demand for eco-friendly transportation alternatives. Passenger drones, particularly those powered by electric propulsion systems, present a viable solution to reduce carbon emissions associated with traditional vehicles. The market for electric drones is projected to expand significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This shift towards sustainable transport options aligns with global initiatives aimed at reducing the carbon footprint of urban mobility. Consequently, the Passenger Drones Market is likely to see a surge in interest from environmentally conscious consumers and policymakers, further driving the adoption of aerial mobility solutions.

Technological Innovations in Drone Design

Technological innovations in drone design are poised to significantly impact the Passenger Drones Market. Advances in battery technology, materials science, and autonomous navigation systems are enhancing the performance and safety of passenger drones. For instance, the development of electric vertical takeoff and landing eVTOL aircraft is revolutionizing the industry, allowing for shorter flight times and reduced noise pollution. According to recent estimates, the eVTOL segment is expected to capture a substantial share of the market, potentially reaching a valuation of several billion dollars by 2030. These innovations not only improve the feasibility of passenger drones but also attract investment and interest from various stakeholders, including governments and private enterprises. As these technologies continue to evolve, the Passenger Drones Market is likely to experience accelerated growth and increased adoption.

Rising Demand for On-Demand Mobility Solutions

The rising demand for on-demand mobility solutions is a key driver of the Passenger Drones Market. Consumers are increasingly seeking flexible and efficient transportation options that cater to their specific needs. The advent of ride-sharing platforms has transformed the way people approach mobility, and passenger drones are positioned to capitalize on this trend. With the potential to provide quick and direct routes, passenger drones could offer a compelling alternative to traditional ride-hailing services. Market analysts suggest that the on-demand mobility sector is expected to grow substantially, with passenger drones playing a pivotal role in this evolution. As urban dwellers seek convenience and speed in their travel experiences, the Passenger Drones Market is likely to expand, driven by the integration of aerial mobility into everyday transportation.

Government Support and Infrastructure Development

Government support and infrastructure development are critical factors shaping the Passenger Drones Market. Many governments are actively investing in the necessary infrastructure to facilitate the integration of passenger drones into existing transportation networks. This includes the establishment of vertiports, air traffic management systems, and regulatory frameworks that ensure safety and efficiency. For example, several countries have initiated pilot programs to test passenger drone operations, demonstrating a commitment to advancing this emerging sector. The financial backing and regulatory clarity provided by governments can significantly enhance the market's growth prospects. As infrastructure continues to develop, the Passenger Drones Market is likely to witness increased operational capabilities and a broader acceptance of aerial mobility solutions among the public.