Advancements in Drone Technology

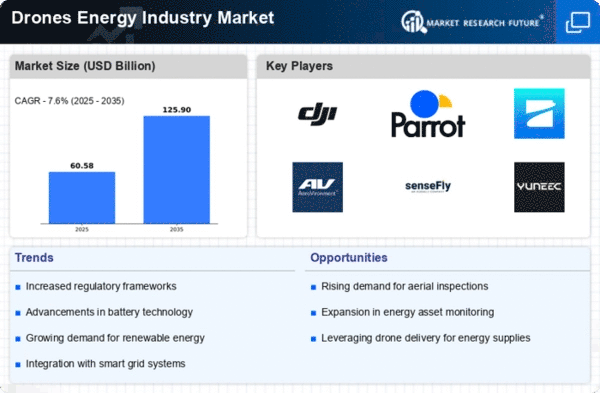

Technological advancements are a pivotal driver of the Drones Energy Industry Market. Innovations in drone capabilities, such as enhanced battery life, improved sensors, and autonomous flight systems, are expanding the range of applications within the energy sector. For example, drones equipped with thermal imaging can detect energy losses in solar panels, leading to more efficient energy management. The market for drone technology is expected to grow at a compound annual growth rate of 15 percent over the next five years. These advancements are likely to enhance the operational efficiency of energy companies, thereby propelling the Drones Energy Industry Market.

Expansion of Infrastructure Development

Infrastructure development is a critical driver for the Drones Energy Industry Market. As countries invest in renewable energy infrastructure, the need for advanced monitoring and maintenance solutions becomes paramount. Drones are employed to conduct aerial inspections of power lines, pipelines, and renewable energy installations, ensuring safety and compliance. The market for drone services in infrastructure is projected to reach USD 1.5 billion by 2027, indicating a robust growth trajectory. This expansion in infrastructure development is expected to propel the Drones Energy Industry Market forward, as stakeholders increasingly recognize the value of drone technology in enhancing operational capabilities.

Growing Demand for Efficient Energy Solutions

The Drones Energy Industry Market is experiencing a notable surge in demand for efficient energy solutions. As energy consumption continues to rise, industries are seeking innovative methods to optimize energy production and distribution. Drones are increasingly utilized for tasks such as surveying solar farms and inspecting wind turbines, which enhances operational efficiency. According to recent data, the integration of drones in energy sectors has the potential to reduce operational costs by up to 30 percent. This growing demand for efficiency is likely to drive investments in drone technology, thereby expanding the Drones Energy Industry Market.

Increased Focus on Environmental Sustainability

The Drones Energy Industry Market is significantly influenced by the heightened focus on environmental sustainability. As organizations strive to minimize their carbon footprints, drones offer a viable solution for monitoring and managing energy resources. For instance, drones can efficiently assess vegetation growth around power lines, reducing the risk of outages and promoting sustainable land use. Furthermore, the use of drones in environmental assessments is projected to grow by 25 percent annually, reflecting a shift towards greener practices. This emphasis on sustainability is likely to catalyze further adoption of drones within the energy sector, thereby bolstering the Drones Energy Industry Market.

Regulatory Frameworks Supporting Drone Operations

The establishment of regulatory frameworks is a crucial driver for the Drones Energy Industry Market. Governments are increasingly recognizing the potential of drones in various sectors, including energy. Regulatory bodies are developing guidelines that facilitate the safe integration of drones into energy operations. For instance, streamlined regulations for drone inspections of energy infrastructure are being implemented, which could lead to a 20 percent increase in drone utilization within the industry. This supportive regulatory environment is expected to foster growth in the Drones Energy Industry Market, as companies seek to leverage drone technology for enhanced operational efficiency.