Increased Defense Budgets

In recent years, many countries have increased their defense budgets, which directly impacts the Global Military Radio System Industry. Nations are recognizing the necessity of modernizing their military capabilities, including communication systems. For example, the United States and NATO countries have allocated substantial funds to enhance their military communication infrastructure. This surge in defense spending is likely to drive demand for advanced radio systems, as military forces require reliable and secure communication channels. Consequently, the market is poised for growth, with projections indicating a rise from 8.95 USD Billion in 2024 to 13.7 USD Billion by 2035.

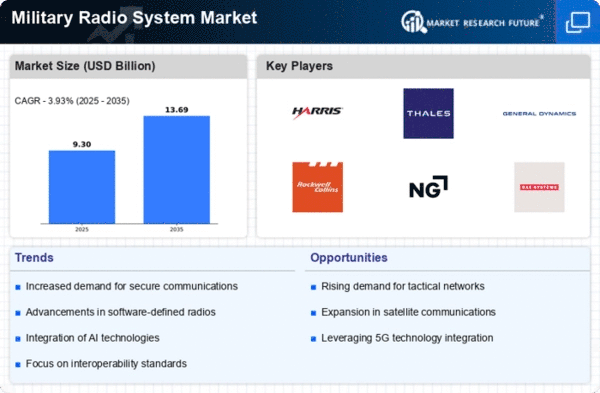

Market Growth Projections

The Global Military Radio System Industry is projected to experience substantial growth over the next decade. The market is expected to expand from 8.95 USD Billion in 2024 to 13.7 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.93% from 2025 to 2035. This growth is driven by various factors, including technological advancements, increased defense budgets, and the rising demand for secure communications. As military forces worldwide continue to modernize their communication systems, the market is likely to witness significant developments and innovations.

Technological Advancements

The Global Military Radio System Industry is experiencing rapid technological advancements, particularly in software-defined radio (SDR) systems. These innovations enhance communication capabilities, allowing for greater flexibility and interoperability among different military branches. For instance, the integration of artificial intelligence in radio systems is expected to improve data processing and decision-making. As military forces worldwide seek to modernize their communication infrastructure, the demand for advanced radio systems is projected to increase significantly. This trend is reflected in the market's anticipated growth from 8.95 USD Billion in 2024 to 13.7 USD Billion by 2035, indicating a robust CAGR of 3.93% from 2025 to 2035.

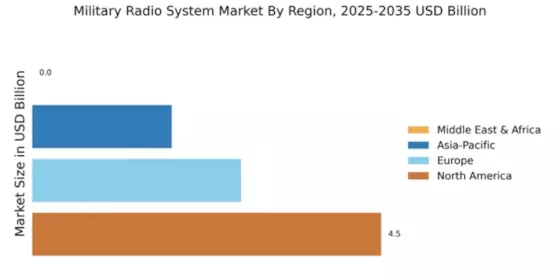

Emerging Markets and Globalization

Emerging markets are becoming increasingly important players in the Global Military Radio System Industry. Countries in regions such as Asia-Pacific and the Middle East are investing heavily in modernizing their military capabilities, including communication systems. This trend is driven by globalization, which encourages collaboration and technology transfer among nations. As these countries seek to enhance their defense capabilities, the demand for advanced military radio systems is likely to rise. This shift is expected to contribute to the overall market growth, with projections indicating an increase from 8.95 USD Billion in 2024 to 13.7 USD Billion by 2035.

Increased Focus on Joint Operations

The Global Military Radio System Industry is witnessing a heightened focus on joint operations among allied forces. As military strategies evolve, the need for seamless communication between different branches of the armed forces becomes paramount. This requirement drives the demand for interoperable radio systems that can facilitate effective communication during joint missions. Countries are investing in advanced military radio technologies to ensure that their forces can operate cohesively. This trend is likely to propel market growth, with expectations of an increase from 8.95 USD Billion in 2024 to 13.7 USD Billion by 2035.

Growing Demand for Secure Communications

The need for secure communication systems is increasingly critical in the Global Military Radio System Industry. As geopolitical tensions rise, military organizations are prioritizing secure communication to protect sensitive information from adversaries. This demand is driving the development of encryption technologies and secure radio systems that can withstand cyber threats. Countries are investing in advanced military radio systems that provide secure and reliable communication channels. The market is expected to grow significantly, with forecasts suggesting an increase from 8.95 USD Billion in 2024 to 13.7 USD Billion by 2035, reflecting the urgent need for secure military communications.