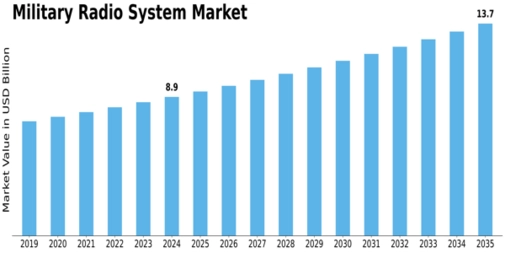

Military Radio System Size

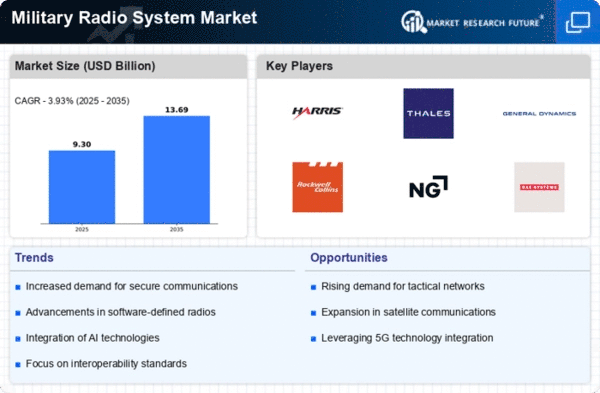

Military Radio System Market Growth Projections and Opportunities

The Military Radio System market is on a high growth trajectory, influenced by several market factors that contribute to its expansion. One of the main drivers behind this development is the increased focus towards modernizing defense communication capabilities worldwide. As military operations become more intricate, secure, reliable and interoperable communication systems are needed most. For effective battlefield communications, military radio systems with advanced features like frequency hopping, encryption and anti-jamming technology remain essential for driving the market growth.

The Military Radio System Market was valued at USD 12.18598 billion with a CAGR of 4.50% projected till 2032. The significant upsurge expected in the military radio system industry over the forecast period is driven primarily by rapid advancements made within handheld product lines as well as software-defined radios (SDRs) integration.

The Military Radio System also depends on commercial-off-the-shelf (COTS) solutions and adoption of software-defined radio architectures among other influences. Governments harness COTS technologies to hasten deploying cutting-edge radio systems at cost-effective prices. The flexibility of software defined radios allows for easier upgrades and modifications thus making sure that military forces can efficiently meet evolving communication needs.

It combines a move toward network-centric warfare and demand for integrated communications ecosystems that drive this sector’s growth rate upwards.Military radio networks are being increasingly incorporated into wider command control networks fostering seamless communications between various platforms or units.This integration makes overall military operations more efficient, presenting manufacturers and solution providers with a favorable market environment.

Another important market factor is the focus on cybersecurity in military communications systems. Military radio systems must now have robust encryption and cyber security features to protect against emerging threats such as cyberattacks. Manufacturers are investing in secure communication solutions that address the unique cyber security challenges facing modern militaries around the world as well as aligning with the strict requirements of defense organizations globally.

Government defense budgets and procurement initiatives have profound effects on this industry. In defense budgets, allocation for communication and networking technologies results into investments towards next generation radio systems. The military radio system market benefits from advanced communications provisions in procurement programs for new military platforms, like vehicles, aircrafts or naval vessels, among others which stimulate its growth.

Leave a Comment