Top Industry Leaders in the Military Radio System Market

Key Companies in the military radio system market include

BARRETT Communications (Australia)

Leonardo SpA (Italy)

Harris Corporation (US)

Radmor SA (Poland)

Thales Communications & Security SAS (France)

Codan Limited (Australia)

Elbit Systems Ltd (Israel)

FLIR Systems (US)

Safran SA (France)

Selex ES (Italy)

Strategies Adopted

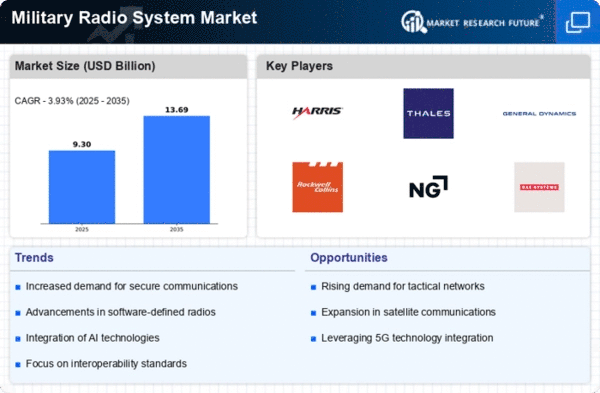

Market share analysis in the Military Radio System segment is influenced by crucial factors such as radio system capabilities, interoperability, and compliance with military communication standards. Pricing strategies play a pivotal role, with companies bidding competitively for defense contracts while ensuring profitability. Establishing strong relationships with defense agencies, military forces, and international security organizations is essential for market share, ensuring a steady stream of contracts and sustaining long-term partnerships.

Emerging Companies

While established players dominate the Military Radio System market, new and emerging companies are entering the sector with innovative approaches. These entrants often focus on niche technologies, such as software-defined radios, electronic countermeasures, and modular systems, to differentiate themselves. The agility of these emerging companies allows them to address specific defense needs, challenging the market dominance of established brands and contributing to the overall diversification of the market.

Industry news within the Military Radio System market frequently highlights advancements in software-defined radio technologies, successful implementations of radio systems in military operations, and collaborations with research institutions for cutting-edge developments. Companies regularly announce contract wins, participation in military exercises, and integration of emerging technologies into their radio systems. Regulatory updates related to defense communication standards, cybersecurity requirements, and international defense cooperation agreements shape industry dynamics, prompting companies to adapt their technologies and solutions accordingly.

Current trends in company investments within the Military Radio System market reflect a notable focus on software-defined radios, electronic warfare capabilities, and cybersecurity measures. Companies allocate resources to develop software-defined radio platforms for flexible and adaptive communication, explore electronic warfare technologies for improved situational awareness, and invest in cybersecurity measures to protect sensitive military communication. Strategic partnerships with defense contractors, participation in defense trade shows, and investments in research and development align with the growing demand for secure and advanced Military Radio Systems.

The overall competitive scenario in the Military Radio System market remains dynamic, with companies navigating evolving defense requirements, emerging technologies, and geopolitical considerations. Established players face the challenge of maintaining technological superiority in a market where emerging companies are leveraging innovation and cost-effectiveness to gain recognition. The competition is expected to intensify as new entrants secure contracts, introducing novel technologies and challenging the market share of established defense contractors. In this environment, adaptability, responsiveness to defense needs, and a commitment to technological excellence will be crucial for companies to maintain and enhance their competitive positions in the Military Radio System market.

Recent News

Won a $166 million contract to supply Falcon III AN/PRC-158M handheld radios to the U.S. Air Force. These advanced radios offer secure voice and data communications for aircrew personnel.

Completed development of its Falcon IV AN/PRC-160M radio, boasting significant improvements in range, bandwidth, and encryption capabilities. This new system caters to the evolving needs of Special Forces and other mission-critical operations.

Partnered with Leonardo DRS to develop joint tactical radio solutions for international armed forces. This collaboration leverages the strengths of both companies to offer comprehensive and interoperable communication systems.

Secured a €1 billion contract from the French Ministry of Defence to upgrade its CONTACT radios. This program will modernize communication infrastructure for the French armed forces, ensuring secure and reliable voice and data exchange across all operational theaters.

Successfully deployed its SPECTRA radios for the Dutch armed forces, marking a significant step towards interoperability with NATO allies. This standardized system facilitates seamless communication and collaboration during joint operations.

Unveiled its latest software-defined radio platform, designed for future soldier programs. This platform offers superior flexibility, scalability, and adaptability to meet the demands of the modern battlefield.

Received a $115 million contract from the U.S. Army to supply LRIP AN/PRC-164 handheld radios. These radios provide secure and interoperable voice and data communications for dismounted soldiers.

Collaborated with Elbit Systems to develop a new network-centric radio system for the Israeli Defense Forces. This system leverages advanced networking technologies for enhanced situational awareness and battlefield management.

Demonstrated the capabilities of its Gemini handheld radio during a recent exercise with the U.S. Marine Corps. Gemini offers robust and secure voice communications even in challenging environments.