Market Analysis

In-depth Analysis of Military Radio System Market Industry Landscape

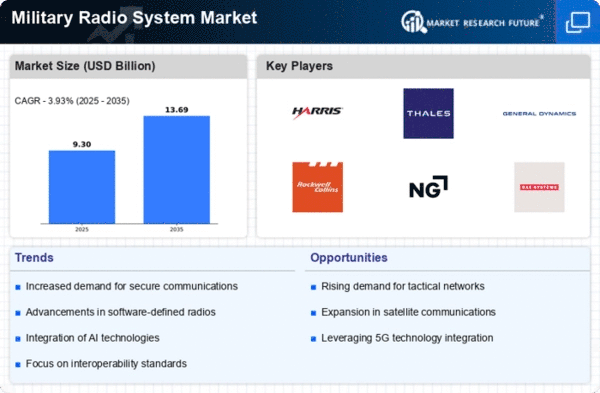

The Military Radio System market is witnessing shifting dynamics resulting from changes in defense strategies, technological advancements as well as the growing need for secure and reliable military communications. The key focus of this market is on developing and deploying radio systems specifically meant to be used by the military to cater for their unique communication needs around the world.

One of the key driving factors behind the Military Radio System industry is ensuring secure and resilient communication networks within the defense sector. For example, modern military operations require that highly sensitive information be transmitted instantaneously and encrypted so as to maintain its integrity and confidentiality. As warfare becomes more complicated, it will increasingly rely on sophisticated radios equipped with secure encryption, frequency hopping technology and anti-jamming capabilities.

Military radio systems are vital requirements during military exercises where there should be confidential, fast and secure communications among participants. This means that as more applications come up that use radio systems such as surgical strikes or residential military areas, there will be a higher demand for these products thus leading to an expanding market.

The market is also influenced by the demand for lightweight and small-sized communication solutions. As military forces operate in more diverse and challenging terrains, there is more focus on developing radio systems that are portable, rugged, and easy to deploy. This has led to innovations in the design of military radios, incorporating materials that can withstand harsh environmental conditions while maintaining high-performance standards.

However we still have some challenges facing the Military Radio System market despite this positive growth trend. Military communication networks are constantly under threat from cyber-attacks requiring frequent improvements in encryption and protection techniques. Meanwhile efforts continue towards assimilating new technologies like Artificial Intelligence (AI) and machine learning to optimize performance and ensure reliability among military radio systems.

Leave a Comment