Market Share

Military Radio System Market Share Analysis

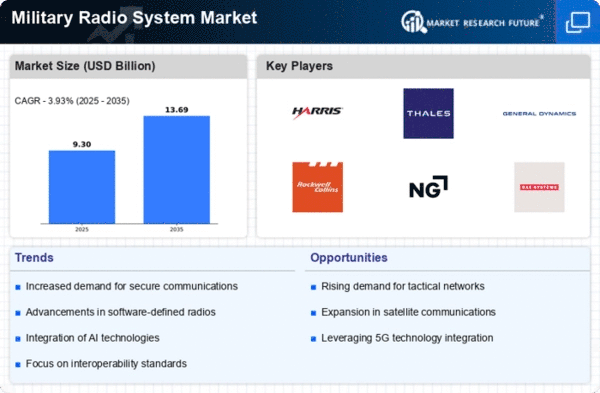

The Military Radio System market is a vital part of the larger defense industry, which is responsible for enabling efficient communication across national armed forces. This is evidenced by most companies aggressively positioning their operations to capture significant market shares through various strategies. Technological innovation remains one of the key drivers of this industry as indicated by huge sums being invested by firms in development of advanced military radios. Some of these innovations include improved encryption, signal range and interoperability that enable secure and seamless communication among armed forces even in diverse operational environments. Leading technological advancements attracts defence agencies looking out for state-of-the-art communication solutions hence securing a bigger share of the market.

Military radio systems are extensively used in various domains such as inter-vehicle communications, dismounted operations, perimeter security, and maritime communications. This has been driven by factors such as the increased deployment of 3G, 4G and LTE networks and the rising investments in defense sectors by developing countries like India, China, Japan, South Korea among others.

Another important aspect of positioning in the market for military radio systems is that it must meet the needs of modern military operations. Companies that design radios capable of integrating with wider networks of military communication stand out in this regard as more and more armed forces are moving towards digitized and network centric operations. Being interoperable with other equipment or scalable to future ones would not only meet immediate requirements but also lead to long-term partnership deals with potential clients thereby increasing market share.

Within the Military Radio System sector strategic alliances play a major role in market positioning. Collaboration with defence contractors, technology providers and government agencies allows pooling resources and expertise by companies. These collaborations can enable development of full-service communication solutions tailored for defence organizations’ specific needs. Joint ventures improve overall capabilities making companies stronger competitors when bidding for large defense contracts which ultimately adds to their market share.

It is important to consider cost-effectiveness when positioning yourself on the battlefield because defense budgets are often tight. Companies providing affordable yet dependable advanced military radio systems have a higher probability of winning contracts. It is therefore vital to establish competitive advantage by streamlining production processes through supply chain optimization while embracing cost-effective technologies so as to capture bigger market share.

The Military Radio System industry requires firms that have strong global presence. This is because military actions occur worldwide thus firms having international coverage can provide goods needed by armed forces from different countries. In order to gain strong global representation it is necessary for businesses to expand their production output and distribution capacity besides understanding different political frameworks within which they operate their business. By doing so they enter new markets and solidify their position in the existing ones thereby increasing market share.

Leave a Comment