Expansion of Renewable Energy Applications

The expansion of renewable energy applications is emerging as a significant driver for The Global Metal Powder Industry. As the world shifts towards sustainable energy solutions, metal powders are increasingly utilized in the production of components for wind turbines and solar panels. The renewable energy sector is projected to grow at a rate of around 20% annually, creating a substantial demand for high-performance metal powders. This trend indicates that manufacturers are likely to focus on developing specialized powders that can withstand harsh environmental conditions, thereby enhancing the market's growth prospects.

Emergence of New Market Players and Startups

The emergence of new market players and startups is reshaping the competitive landscape of The Global Metal Powder Industry. These entities are often characterized by their innovative approaches and agility, allowing them to introduce novel products and solutions. Recent trends suggest that the number of startups in the metal powder sector has increased by approximately 30% in the last two years, indicating a vibrant ecosystem. This influx of new players not only intensifies competition but also drives innovation, as established companies may need to adapt to maintain their market positions. Consequently, this dynamic environment is likely to contribute to the overall growth of the market.

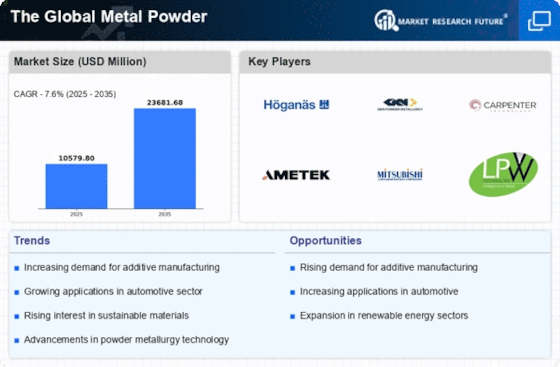

Growth of Additive Manufacturing Technologies

Additive manufacturing technologies, particularly 3D printing, are revolutionizing the production processes across various industries, thereby influencing The Global Metal Powder Industry. The market for metal powders used in additive manufacturing is expected to expand significantly, with estimates indicating a growth rate of around 25% annually. This growth is attributed to the ability of metal powders to create complex geometries and reduce material waste, which aligns with modern manufacturing goals. As industries seek to innovate and optimize production, the demand for specialized metal powders tailored for additive manufacturing applications is likely to increase, further solidifying the market's trajectory.

Increasing Investment in Research and Development

Investment in research and development is a critical driver for The Global Metal Powder Industry, as companies strive to innovate and enhance product offerings. The focus on developing new alloys and improving powder production techniques is expected to yield advanced materials with superior properties. Recent data indicates that R&D spending in the metal powder sector has risen by approximately 15% over the past year, reflecting a commitment to technological advancement. This investment not only fosters innovation but also enables manufacturers to meet the evolving needs of various applications, thereby expanding the market's potential.

Rising Demand in Aerospace and Automotive Sectors

The aerospace and automotive sectors are experiencing a notable surge in demand for advanced materials, which is likely to drive The Global Metal Powder Industry. The increasing need for lightweight and high-strength components in aircraft and vehicles is propelling the adoption of metal powders. For instance, the aerospace industry is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years, leading to a heightened requirement for metal powders used in additive manufacturing and other processes. This trend suggests that manufacturers are increasingly turning to metal powders to meet stringent performance and safety standards, thereby enhancing the overall market landscape.