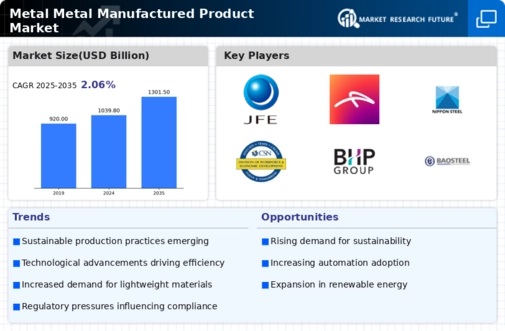

Rising Demand for Lightweight Materials

The Metal Manufactured Product Market is experiencing a notable increase in demand for lightweight materials, particularly in sectors such as automotive and aerospace. Manufacturers are increasingly adopting aluminum and titanium alloys due to their favorable strength-to-weight ratios. This shift is driven by the need for improved fuel efficiency and reduced emissions, aligning with environmental regulations. In 2025, the demand for lightweight metals is projected to grow by approximately 15%, reflecting a broader trend towards sustainability. As industries seek to enhance performance while minimizing environmental impact, the Metal Manufactured Product Market is likely to benefit from this transition, fostering innovation and new product development.

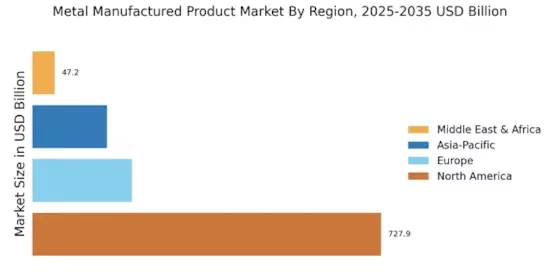

Infrastructure Investment and Urbanization

The Metal Manufactured Product Market is poised to benefit from increased infrastructure investment and urbanization trends. Governments and private sectors are allocating substantial budgets for infrastructure projects, including transportation, energy, and housing. In 2025, global infrastructure spending is projected to exceed USD 4 trillion, creating a surge in demand for metal products used in construction and engineering. This trend is particularly evident in emerging markets, where urbanization is driving the need for robust infrastructure. As a result, the Metal Manufactured Product Market is likely to experience heightened activity, with manufacturers ramping up production to meet the growing needs of these sectors.

Growing Focus on Renewable Energy Solutions

The Metal Manufactured Product Market is increasingly influenced by the global shift towards renewable energy solutions. As countries strive to meet energy transition goals, there is a rising demand for metals used in renewable energy technologies, such as solar panels and wind turbines. In 2025, the renewable energy sector is expected to require over 1 million tons of specialized metals, indicating a substantial market opportunity. This trend not only supports the growth of the Metal Manufactured Product Market but also aligns with broader sustainability initiatives. Manufacturers are likely to adapt their product lines to cater to this evolving demand, fostering innovation in metal applications.

Regulatory Compliance and Quality Standards

The Metal Manufactured Product Market is increasingly shaped by stringent regulatory compliance and quality standards. Governments and industry bodies are implementing regulations to ensure product safety, environmental sustainability, and performance reliability. In 2025, compliance with these standards is expected to drive a 10% increase in demand for certified metal products. This trend compels manufacturers to invest in quality assurance processes and certifications, thereby enhancing their market competitiveness. As companies navigate these regulatory landscapes, the Metal Manufactured Product Market is likely to witness a shift towards higher quality and more sustainable manufacturing practices.

Technological Innovations in Metal Processing

Technological advancements in metal processing techniques are significantly influencing the Metal Manufactured Product Market. Innovations such as additive manufacturing and advanced welding technologies are enabling the production of complex geometries and customized components. These technologies not only enhance efficiency but also reduce material waste, aligning with sustainability goals. In 2025, the market for advanced manufacturing technologies is expected to reach USD 10 billion, indicating a robust growth trajectory. As companies invest in these technologies, the Metal Manufactured Product Market is poised for transformation, potentially leading to new applications and improved product offerings.