Growing Aging Population

The aging population worldwide is a significant driver of the Global Medical Carts Market Industry. As the demographic shift continues, there is an increasing prevalence of chronic diseases that require ongoing medical attention. This trend necessitates the use of medical carts that can efficiently store and transport medical supplies and equipment needed for elderly care. The market's projected growth to 5.5 USD Billion by 2035 reflects the increasing demand for healthcare services tailored to the elderly. Consequently, healthcare providers are likely to invest in medical carts that enhance their ability to deliver care to this growing segment of the population.

Market Growth Projections

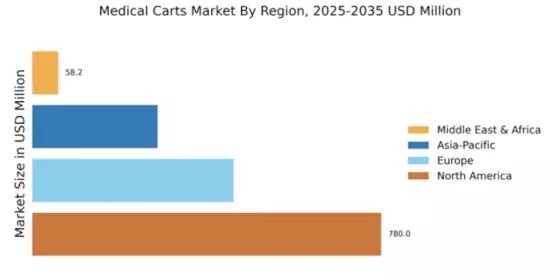

The Global Medical Carts Market Industry is projected to experience substantial growth over the next decade. With a market value of 3.46 USD Billion in 2024, it is expected to reach 5.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.3% from 2025 to 2035. The increasing demand for mobile healthcare solutions, coupled with advancements in technology and a focus on patient safety, is likely to drive this expansion. As healthcare providers seek to enhance their operational efficiency and patient care capabilities, the market for medical carts is poised for significant development.

Increased Focus on Infection Control

Infection control remains a critical concern in healthcare settings, driving the Global Medical Carts Market Industry. The ongoing emphasis on maintaining sterile environments has led to a demand for medical carts designed with infection prevention features. These carts often include materials that are easy to clean and disinfect, thereby reducing the risk of cross-contamination. As healthcare facilities prioritize patient safety, the adoption of specialized medical carts is likely to rise. This trend is indicative of a broader movement towards enhancing hygiene standards in healthcare, which is expected to contribute to the market's growth trajectory over the coming years.

Regulatory Compliance and Standardization

Regulatory compliance and standardization are crucial factors influencing the Global Medical Carts Market Industry. Healthcare facilities are required to adhere to strict regulations regarding the storage and transportation of medical supplies. This has led to an increased demand for medical carts that meet these regulatory standards. Manufacturers are responding by designing carts that comply with safety and quality regulations, ensuring that healthcare providers can maintain compliance while optimizing their operations. The anticipated compound annual growth rate of 4.3% from 2025 to 2035 indicates a sustained interest in compliant medical carts, as healthcare facilities prioritize adherence to regulations.

Rising Demand for Efficient Healthcare Delivery

The Global Medical Carts Market Industry is experiencing a surge in demand for efficient healthcare delivery systems. As healthcare facilities strive to improve patient outcomes, the need for mobile medical carts that facilitate quick access to medical supplies and equipment becomes paramount. In 2024, the market is projected to reach 3.46 USD Billion, reflecting the increasing emphasis on streamlined workflows in hospitals and clinics. This trend is likely to continue as healthcare providers recognize the importance of mobility and organization in enhancing patient care. The integration of technology into these carts further supports this demand, enabling better inventory management and reducing response times.

Technological Advancements in Medical Equipment

Technological advancements play a pivotal role in shaping the Global Medical Carts Market Industry. Innovations such as integrated electronic health record systems and telemedicine capabilities are increasingly being incorporated into medical carts. These advancements not only enhance the functionality of the carts but also improve the overall efficiency of healthcare delivery. As a result, healthcare providers are more inclined to invest in modern medical carts that can support these technologies. The anticipated growth of the market to 5.5 USD Billion by 2035 underscores the potential of these advancements to transform healthcare environments, making them more responsive to patient needs.