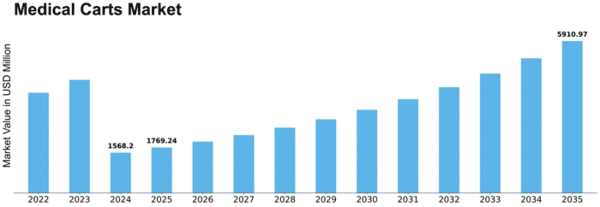

Medical Carts Size

Medical Carts Market Growth Projections and Opportunities

In healthcare situations, where avoiding infections is very important, medical carts that come with built-in germ-fighting tools are becoming more popular. More and more people want surfaces that kill germs, materials that are easy to clean, and tasks that you can do without using your hands. Obviously, these traits help keep the area clean and lower the chance of getting illnesses connected to healthcare. It's being changed so that there is room for virtual care as the number of people using telehealth services grows. Professionals in health care can talk and do tests from far away, which means that more people can get care. This is possible with carts that have video and voice features, safe ways to communicate, and telemedicine add-ons. There are more and more hospital carts with wheels or power being made because people want them. It is easier to move around with these carts, which are especially helpful in bigger medical centers. Putting together power systems makes it easy to move big tools and help people quickly when they need it. Many hours of work went into making medical carts more comfortable so that people who work in healthcare can have a better experience overall. Healthcare workers who use these carts for their daily work are more comfortable and get more done thanks to features like adjustable height, easy mobility, and screens that are simple to use. People who work in health care systems around the world are realizing how useful these portable carts are, so the market for them is growing very quickly. More and more medical carts are being used in different types of healthcare settings. This is possible because businesses are teaming up in smart ways to expand into new areas. Medical cart sales are going up because more and more people need good choices for when they get medical care. Electronic health records (EHRs) and drug delivery systems are two technologies that are being used together more and more in medical carts to make things run more easily and improve care for patients. A lot of the medical cart business is changed by how quickly technology changes. Technologies like RFID tracking, tag reading, and telemedicine make healthcare more efficient by making sure that the right information about patients is kept and that the right medicines are given. The business of medical carts is growing a lot because more money is being spent on health care around the world. More hospitals are spending money to make things run more easily and get better results for their patients. This is making the market for better medical carts grow. More and more people are buying medical carts with parts and features that make cleaning and washing easier. This is because avoiding infections is very important in healthcare situations. Because of the need to stop infections, healthcare facilities are being pushed to buy carts that help keep the areas clean. Most people want medical carts because more people have long-term illnesses and more people are getting older. More and more people need mobile health care options as the population ages. You can use these ideas in long-term care facilities, at home, and other places. Medical businesses are using medical carts that are made to fit their needs and ways of working more and more. A design that is ergonomic is focused on the comfort and efficiency of workers. It lowers the risk of accidents at work and increases overall output. The biggest companies in the medical cart business are fighting hard with each other. Companies often buy other companies, join with each other, and make strategic deals to offer more goods on the market. The way markets work is affected by how competitive they are, which also helps new ideas grow.

Leave a Comment