Market Growth Projections

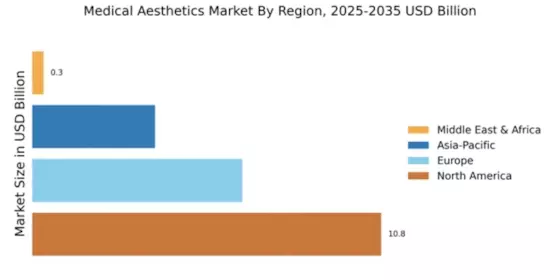

The Global Medical Aesthetics Market Industry is projected to experience substantial growth in the coming years. With a market value of 27.2 USD Billion in 2024, it is anticipated to reach 130.2 USD Billion by 2035. This remarkable growth trajectory indicates a compound annual growth rate (CAGR) of 15.28% from 2025 to 2035. Such projections suggest a robust demand for aesthetic treatments, driven by factors such as technological advancements, increasing consumer awareness, and a growing aging population. This upward trend underscores the industry's potential and highlights the importance of strategic investments and innovations to capitalize on emerging opportunities.

Rising Demand for Non-Invasive Procedures

The Global Medical Aesthetics Market Industry experiences a notable increase in demand for non-invasive aesthetic procedures. This trend is driven by a growing preference among consumers for treatments that offer minimal downtime and reduced risk compared to surgical options. For instance, procedures such as Botox and dermal fillers have gained immense popularity, appealing to a broad demographic. As of 2024, the market is valued at approximately 27.2 USD Billion, reflecting a shift towards less invasive solutions. This consumer inclination suggests a potential for sustained growth in the sector, as more individuals seek accessible and effective aesthetic enhancements.

Increasing Awareness of Aesthetic Treatments

The Global Medical Aesthetics Market Industry benefits from a rising awareness of aesthetic treatments among consumers. Educational campaigns and social media influence have significantly contributed to this trend, as individuals become more informed about the benefits and availability of aesthetic procedures. This heightened awareness encourages more people to consider aesthetic enhancements, thereby expanding the consumer base. Additionally, the portrayal of aesthetic treatments in popular culture and media further normalizes these procedures, making them more accessible. As awareness continues to grow, the market is poised for further expansion, potentially reaching substantial figures in the coming years.

Technological Advancements in Aesthetic Devices

Technological innovations play a pivotal role in shaping the Global Medical Aesthetics Market Industry. The introduction of advanced devices, such as laser technologies and radiofrequency systems, enhances the efficacy and safety of aesthetic treatments. These innovations not only improve patient outcomes but also expand the range of available procedures. For example, the development of fractional laser technology has revolutionized skin resurfacing, providing superior results with minimal side effects. As the industry progresses, these advancements are likely to drive market growth, contributing to an anticipated market value of 130.2 USD Billion by 2035, with a CAGR of 15.28% projected for 2025-2035.

Expansion of Aesthetic Clinics and Accessibility

The Global Medical Aesthetics Market Industry is witnessing an expansion of aesthetic clinics, enhancing accessibility for consumers. The proliferation of these clinics, often located in urban areas, provides individuals with greater opportunities to access aesthetic treatments. This trend is further supported by the increasing number of trained professionals entering the field, ensuring that a diverse range of services is available. As clinics become more widespread, the stigma associated with aesthetic procedures diminishes, encouraging more individuals to seek treatments. This expansion is likely to play a crucial role in driving market growth, as accessibility remains a key factor in consumer decision-making.

Aging Population and Demand for Anti-Aging Solutions

An aging population globally drives the demand for anti-aging solutions within the Global Medical Aesthetics Market Industry. As individuals seek to maintain a youthful appearance, there is an increasing inclination towards aesthetic treatments that address signs of aging. This demographic shift is particularly pronounced in developed countries, where a significant portion of the population is over 50. Treatments such as skin rejuvenation and wrinkle reduction are in high demand, reflecting a societal trend towards prioritizing appearance and self-care. This growing demand is expected to contribute to the industry's robust growth trajectory, aligning with broader demographic trends.